Why many investors are turning to AI tools

Get one year of access to Amsflow’s AI-powered financial analysis platform

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Get one year of access to Amsflow’s AI-powered financial analysis platform

Warren Buffet ignored his own private equity advice – and paid the price AxiosTrump tariffs live updates: US outlines new tariff guidance as India calls Trump’s warning ‘unjustified’ Yahoo FinanceNot Even Warren Buffett Wins 'Em All—Recent Losses on Two Big Investments Prove It InvestopediaBerkshire Earnings Key Takeaways: Strong Profit, No Buybacks, and a Falling Stock Barron'sWarren Buffett's Berkshire Hathaway spelled out where tariffs were hitting it Business Insider

Fox Corp (NASDAQ:FOX) (NASDAQ:FOXA) reported fiscal fourth-quarter results on Tuesday.The company reported quarterly revenue of $3.29 billion. That’s up from $3.09 billion a year ago, exceeding the analyst consensus estimate of $4.16 billion. Adjusted net income was $581 million, or $1.27 per share, beating the analyst consensus estimate of 99 cents. It was $423 million or 90 cents per share a year ago.Also Read: Fox Backs The Lighthouse To Develop Creator-Led FranchisesThe stock gained after the report.Cable Network Programming reported quarterly segment revenues of $1.53 billion, an increase of 7% Y/Y. Television reported quarterly segment revenues of $1.71 billion, ...Full story available on Benzinga.com

U.S. stocks were lower, with the Dow Jones index gaining around 100 points on Tuesday.Shares of Sterling Infrastructure, Inc. (NASDAQ:STRL) rose sharply during Tuesday's session after the company reported better-than-expected quarterly financial results and raised its FY25 guidance.Sterling Infrastructure reported quarterly earnings of $2.69 per share which beat the analyst consensus estimate of $1.97 per share. The company reported quarterly sales of $614.468 million which beat the analyst consensus estimate of $554.350 million.Sterling Infrastructure shares jumped 16.8% to $317.62 on Tuesday.Here are some other big stocks recording gains in today’s session.Ameresco, Inc. (NYSE:AMRC) shares jumped 41.4% to $23.61 after the company reported better-than-expected quarterly financial results.Arteris, Inc. (NASDAQ:AIP) jumped 37.6% to $13.01 after the company announced a deal with AMD for its next generation of AI chiplet design.Xometry, Inc. (NASDAQ:XMTR) ...Full story available on Benzinga.com

Faruqi & Faruqi, LLP Securities Litigation Partner James (Josh) Wilson Encourages Investors Who Suffered Losses Exceeding $75,000 In Fiserv To Contact Him Directly To Discuss Their OptionsIf you suffered losses exceeding $75,000 in Fiserv between July 24, 2024 and July 22, 2025 and would like to discuss your legal rights, call Faruqi & Faruqi partner Josh Wilson directly at 877-247-4292 or 212-983-9330 (Ext. 1310).[You may also click here for additional information]NEW YORK, Aug. 05, 2025 (GLOBE NEWSWIRE) -- Faruqi & Faruqi, LLP, a leading national securities law firm, is investigating potential claims against Fiserv, Inc. ("Fiserv" or the "Company") (NYSE:FI) and reminds investors of the September 22, 2025 deadline to seek the role of lead plaintiff in a federal securities class action that has been filed against the Company.Faruqi & Faruqi is a leading national securities law firm with offices in New York, Pennsylvania, California and Georgia. The firm has recovered hundreds of millions of dollars for investors since its founding in 1995. See www.faruqilaw.com.As detailed below, the complaint alleges that the Company and its executives violated federal securities laws by making false and/or misleading statements and/or failing to disclose that: (a) ...Full story available on Benzinga.com

Coinbase Global (NASDAQ:COIN) stock dropped on Tuesday after it announced plans to offer $2 billion in convertible senior notes—$1 billion due in 2029 and $1 billion in 2032—through a private placement to qualified institutional buyers under Rule 144A.If initial purchasers exercise their options, the company may offer up to an additional $300 million across both series.Coinbase structured the notes as senior unsecured obligations, convertible into cash, stock, or a combination at its discretion.Also Read: Why Coinbase’s Huge Rally Might Be DoneThe company plans to use part of the proceeds to fund capped call transactions, which aim to minimize dilution and offset potential cash payments related to note conversions.Coinbase intends ...Full story available on Benzinga.com

BREAKING MONDAY ... AG BONDI ORDERS ACTION ON RUSSIAGATE ... GRAND JURY INCOMING ... FOX: DOJ launching grand jury investigation into Russiagate conspiracy allegations: sourcesAttorney General Pam Bondi directed her staff Monday to act on the criminal referral from Director of National Intelligence Tulsi Gabbard related to the alleged conspiracy to tie President Donald Trump to Russia, and the Department of Justice is now opening a grand jury investigation into the matter, Fox News Digital has learned.

Saudi Arabian oil company Aramco reported a 22 per cent drop in second-quarter profit, and the world’s top oil exporter said it was cutting costs.

San Diego-based MEI Pharma (NASDAQ:MEIP) has acquired 929,548 Litecoin (CRYPTO: LTC) tokens, becoming the first U.S.-listed public company to adopt Litecoin as its primary treasury reserve asset.What Happened: The acquisition, valued at approximately $110.4 million as of Aug. 4, marks the launch of a $100 million institutional treasury strategy in collaboration with crypto market maker GSR and Litecoin creator Charlie Lee.The company said it purchased the LTC tokens at an average price of $107.58, positioning the crypto asset as a strategic alternative to traditional reserve holdings. The move follows a broader trend of public firms exploring digital assets as part of long-term capital diversification.“Litecoin has long embodied sound, scalable, and decentralized money,” said Charlie Lee, who also sits on MEI’s board. "By initiating this strategy, MEI is taking a clear, institutional step ...Full story available on Benzinga.com

Dow Jones Futures: Palantir Jumps On Earnings; Figma, Nvidia, Spotify, Tesla Are Big Movers Investor's Business DailyStock market today: Dow jumps 500 points, S&P 500, Nasdaq rally in bounce back from Friday sell-off Yahoo FinanceIndexes post biggest daily pct gains since May 27 in rebound from Friday selloff ReutersDow leaps 585 points as US stocks win back most of Friday’s wipeout apnews.comStock Markets Face More Shocks After Jobs Data, Watch the Fed and Earnings. 5 More Things to Know Today. Barron's

BP makes biggest find in 25 years as it refocuses on fossil fuels BBCBP makes its biggest oil and natural gas discovery in 25 years as it refocuses on fossil fuels CNNBP hails Brazil block as its largest global oil and gas find in 25 years Reutersbp announces hydrocarbon discovery at Bumerangue exploration well, offshore Brazil | News and insights | Home BPBP makes its biggest oil and gas discovery in 25 years off coast of Brazil The Guardian

Explore the best GPS trackers for kids in 2025 with smart features, real-time updates, and child-friendly designs.

'Open The Floodgates': Why Tesla's $243 Million Autopilot Crash Verdict Is Such A Big Deal InsideEVsTesla found partly to blame for fatal Autopilot crash BBCTesla ordered by Florida jury to pay $243 million in fatal Autopilot crash ReutersElon Musk Faces Another Rough Week Vanity FairTesla withheld data, lied, and misdirected police and plaintiffs to avoid blame in Autopilot crash Electrek

Amazon Breaks Up Wondery Podcast Studio, CEO Jen Sargent Departs The Hollywood ReporterAmazon to Cut Wondery Staff, Reorganize Audio Business BloombergMemo: Amazon breaks up its podcast studio and lays off over 100 Business InsiderAmazon lays off over 100 employees in Wondery unit as part of audio business restructuring CNBCAmazon Reorganizes Audio Divisions, Shrinking Wondery Studio And Laying Off 100-Plus Staffers Deadline

Build a professional Squarespace website or portfolio to impress at interviews. Save 10% on your new subscription with our exclusive promo code.

Growing menu of options offers customers more savings and better control over how they use their energySome incentives have doubled or even tripledGREENVILLE, S.C., Aug. 4, 2025 /PRNewswire/ -- Duke Energy has increased incentives and eligibility for many of its residential and business energy efficiency and demand response programs in South Carolina, expanding ways customers can save energy and money. The updates were approved by the Public Service Commission of South Carolina (PSCSC) and launched on Aug. 1, 2025. "Some of our program incentives have doubled – or even tripled – making now an even more rewarding time to make energy efficiency improvements or enroll in programs at your home or business to help save," said Tim Pearson, Duke Energy's South Carolina president. "With the recent enactment of the S.C. Energy Security act, our state's leaders have also signaled the importance of these ...Full story available on Benzinga.com

Sfmg LLC lifted its holdings in Lowe’s Companies, Inc. (NYSE:LOW – Free Report) by 1.3% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 5,458 shares of the home improvement retailer’s stock after buying an additional 71 shares during the quarter. Sfmg LLC’s [...]

ROI Financial Advisors LLC decreased its stake in shares of Intel Corporation (NASDAQ:INTC – Free Report) by 17.5% during the first quarter, according to the company in its most recent filing with the SEC. The fund owned 15,513 shares of the chip maker’s stock after selling 3,287 shares during the period. ROI Financial Advisors LLC’s [...]

W.H. Cornerstone Investments Inc. reduced its stake in Linde PLC (NASDAQ:LIN – Free Report) by 40.2% during the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 892 shares of the basic materials company’s stock after selling 600 shares during the period. W.H. Cornerstone Investments Inc.’s [...]

Seelaus Asset Management LLC trimmed its stake in Thermo Fisher Scientific Inc. (NYSE:TMO – Free Report) by 7.0% in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 1,666 shares of the medical research company’s stock after selling 125 shares during the [...]

W.H. Cornerstone Investments Inc. lowered its position in shares of Lowe’s Companies, Inc. (NYSE:LOW – Free Report) by 20.2% in the first quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 2,686 shares of the home improvement retailer’s stock after selling 680 shares during the [...]

Accent Capital Management LLC bought a new stake in Aon plc (NYSE:AON – Free Report) in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm bought 101 shares of the financial services provider’s stock, valued at approximately $40,000. A number of other hedge funds and [...]

Accent Capital Management LLC increased its stake in shares of Thermo Fisher Scientific Inc. (NYSE:TMO – Free Report) by 7.3% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 916 shares of the medical research company’s stock after buying an [...]

JGP Global Gestao de Recursos Ltda. bought a new stake in shares of AbbVie Inc. (NYSE:ABBV – Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund bought 3,355 shares of the company’s stock, valued at approximately $703,000. AbbVie makes up about [...]

Westfield Capital Management Co. LP decreased its holdings in shares of Vulcan Materials Company (NYSE:VMC – Free Report) by 9.1% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 254,781 shares of the construction company’s stock after selling 25,419 shares during [...]

W.H. Cornerstone Investments Inc. purchased a new stake in shares of Illinois Tool Works Inc. (NYSE:ITW – Free Report) during the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm purchased 3,489 shares of the industrial products company’s stock, valued at approximately $865,000. A number of [...]

Sfmg LLC lowered its position in Abbott Laboratories (NYSE:ABT – Free Report) by 3.8% in the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 4,414 shares of the healthcare product maker’s stock after selling 172 shares during the quarter. Sfmg [...]

Accent Capital Management LLC bought a new position in Wells Fargo & Company (NYSE:WFC) during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 404 shares of the financial services provider’s stock, valued at approximately $29,000. A number of other institutional investors have also added to or [...]

Seelaus Asset Management LLC bought a new stake in shares of TE Connectivity Ltd. (NYSE:TEL – Free Report) during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The fund bought 3,196 shares of the electronics maker’s stock, valued at approximately $452,000. Other hedge funds and other institutional [...]

Westfield Capital Management Co. LP bought a new stake in Howmet Aerospace Inc. (NYSE:HWM – Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The firm bought 1,135,059 shares of the company’s stock, valued at approximately $147,251,000. Westfield Capital Management Co. LP owned [...]

ROI Financial Advisors LLC bought a new position in Abbott Laboratories (NYSE:ABT – Free Report) in the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund bought 1,563 shares of the healthcare product maker’s stock, valued at approximately $207,000. Several other hedge funds and other institutional investors also [...]

Accent Capital Management LLC acquired a new stake in shares of Wells Fargo & Company (NYSE:WFC) in the first quarter, according to the company in its most recent disclosure with the SEC. The firm acquired 404 shares of the financial services provider’s stock, valued at approximately $29,000. A number of other institutional investors and hedge [...]

Exclusive | China Is Choking Supply of Critical Minerals to Western Defense Companies The Wall Street JournalExclusive: Trump administration to expand price support for US rare earths projects, sources say ReutersTrump Team Outlines Push for Rare Earths in Meeting With Executives Bloomberg.comThe U.S. Critical Minerals Dilemma: What to Know Council on Foreign RelationsRare earths are China’s bargaining chip in the trade war — the U.S. is trying to fix that CNBC

A man fell to his death during Saturday night's Oasis concert at London's Wembley Stadium. The man, in his 40s, was reportedly sitting in the upper levels of the stadium, which seats 90,000 and features seats as high as 164 feet above the ground, the Guardian reports. Police say...

Trade Desk thrives in programmatic ads with strong financials, but valuation concerns persist.

Ed Yardeni, President of Yardeni Research tells CNBC's Squawk Box Asia that the weakness in the latest U.S. jobs report is likely due to the lack of labor supply, not demand and the September Fed rate cut is not a sure thing.

ADEN, Aug 3 (Reuters) – At least 54 died when a boat carrying around 150 people sank off Yemen’s coast in bad weather on Sunday, with dozens still unaccounted for, health officials said....

DGRW's rule-based strategy prioritizes quality stocks with strong dividend growth. Click here to read why I rate DGRW ETF a Buy.

The July Jobs report by the Bureau of Labor Statistics, released on Friday, is raising concerns among economists, who warn that the latest data and sharp downward revisions point to a labor market that is losing momentum and potentially edging toward a recession.What Happened: On Sunday, in a post on X, former Treasury Secretary Lawrence Summers said that the U.S. economy was “closer to stall speed than we thought,” citing the bleak figures published in the report. Besides the disappointing payroll growth of just 73,000 during the month, far short of the expected 110,000, Summers says “the big deal” is the downward revisions for May and June, which now show job growth of just 19,000 and 14,000, respectively, down from the initial estimates of 144,000 and 147,000.See Also: Trump’s Trade Deals, Tariffs, The Tumbling Labor Market And More: This Week In Economy“That means there is a real possibility that we’re in a stall speed kind of economy,” Summers says, warning that “we could tip over into recession”I think the Friday jobs report told us that ...Full story available on Benzinga.com

YieldMax PLTR Option Income Strategy ETF offers a high 59% yield through a covered call strategy on Palantir. Read why I rate PLTY a Buy.

.jpg?itok=PQVSy6BD)

RFK Jr. Announces Repeal Of Policy That Rewarded Hospitals For Reporting Staff Vaccination Rates Authored by Jeff Louderback via The Epoch Times (emphasis ours),In his department’s latest move related to vaccine-related reform, Health and Human Services Secretary Robert F. Kennedy Jr. on Aug. 1 announced more repeals of federal policy that rewarded hospitals for reporting staff vaccination rates.Health Secretary Robert F. Kennedy Jr. testifies before a Senate Appropriations subcommittee on Capitol Hill in Washington on May 20, 2025. Madalina Vasiliu/The Epoch TimesKennedy said in a press release that the policy was coercive and denied informed consent.“Medical decisions should be made based on one thing: the wellbeing of the person—never on a financial bonus or a government mandate,” Kennedy said. “Doctors deserve the freedom to use their training, follow the science, and speak the truth without fear of punishment.”Created under the Biden administration’s Centers for Medicare & Medicaid Services (CMS) inpatient payment rule, the policy linked hospital reimbursement to staff vaccination reporting.“Doctors and other providers should have the same autonomy to choose what’s right for their own individual health care needs as the patients for whom they care. Today’s announcement helps put that power back in their hands,” CMS Administrator Dr. Mehmet Oz said in the press release.The move represents the most recent policy repeal under CMS. These moves are “part of a broader HHS effort to restore medical autonomy in federally funded programs and root out financial and regulatory pressures that incentivize physicians towards pre-scripted medical decisions rather than individualized, evidence-based care,” according to the press release.Since taking office as HHS secretary, Kennedy has implemented multiple changes regarding vaccines.The Food and Drug Administration in late May said it planned to limit access to future COVID vaccines to people 65 and older and individuals with underlying health conditions.The agency also announced it would permit vaccine manufacturers to coordinate in-depth studies to assess the efficacy and safety of COVID vaccines in children and younger, healthy adults.In recent months, HHS has also dismissed all 17 members of the Centers for Disease Control and Prevention vaccine advisory panel, ended the CDC’s COVID-19 vaccine recommendations for pregnant women and healthy children, and ordered the removal of mercury from influenza vaccines.After it voted to advise officials to stop recommending influenza shots that have mercury, the remade Advisory Committee on Immunization Practices (ACIP) said it plans to look at multiple other vaccines.Martin Kulldorff, the new chair of ACIP, said on June 26 that one proposal is to notify the CDC that young children should not receive the measles, mumps, rubella, and varicella (MMRV) combination immunization.The agency instead would recommend that children under the age of 47 months get two separate vaccines: the measles, mumps, rubella shot, and the varicella, or chickenpox, vaccine.Martin Kulldorff, the new chair of the CDC's Advisory Committee on Immunization Practices, during a committee meeting in Atlanta, Ga., on June 25, 2025. Elijah Nouvelage/Getty ImagesKulldorff noted that the change would reflect data that indicate the MMRV combination vaccine causes more febrile seizures. The CDC reported the same information in a background paper dated June 25.A vote on the issue could happen as early as the next ACIP meeting, which is expected to be held in August or September.Dr. Tina Tan, president of the Infectious Diseases Society of America, said in a statement that “re-examining the childhood vaccine schedule and the use of thimerosal are both politically motivated actions that are not based on science.”“Raising questions without adequate data casts doubt on vaccination, which can further drive down confidence in vaccines. More than any other medications, vaccines are extensively and constantly reviewed and evaluated,” she added.During the ACIP meeting, Kulldorff explained that Kennedy had given the committee “a clear mandate to use evidence-based medicine for making vaccine recommendations.”“Vaccines are not all good or bad. If you think that all vaccines are safe and effective and want them all, or if you think that all vaccines are dangerous and don’t want any of them, then you don’t have much use for us—you already know what you want,” he said.“But if you wish to know which vaccines are suitable for you and your children and at what ages, then we will provide you with evidence-based recommendations,” he added.ACIP members who were removed by Kennedy said the panel has “lost credibility.” The former members wrote in a July 30 New England Journal of Medicine commentary that the process for recommending vaccines is “rapidly eroding.”On Aug. 1, the CDC notified some outside groups that they can no longer participate in panels that review vaccine data and form recommendations for the ACIP.The panels meet behind closed doors and typically include members of the ACIP, which advises the CDC on vaccines. The workgroups are also composed of experts from liaison organizations like the American Academy of Pediatrics.Groups that employ the experts have been informed that they won’t be part of the workgroups any longer, the Department of Health and Human Services (HHS), the CDC’s parent agency, told The Epoch Times on Aug. 1.An official said some groups are being removed from the workgroups because of concerns that they have conflicts of interest.For instance, the American Pharmacists Association lists vaccine manufacturers such as GlaxoSmithKline and Moderna among its corporate supporters.“Under the old ACIP, outside pressure to align with vaccine orthodoxy limited asking the hard questions. The old ACIP members were plagued by conflicts of interest, influence, and bias. We are fulfilling our promise to the American people to never again allow those conflicts to taint vaccine recommendations,” Andrew Nixon, a spokesman for the HHS, told The Epoch Times in an email.A healthcare worker fills a syringe with the Pfizer COVID-19 vaccine at Jackson Memorial Hospital in Miami on Oct. 5, 2021. Lynne Sladky/AP PhotoLast month, six medical organizations—including the American Academy of Pediatrics (AAP), the American College of Physicians (ACP) and the Society for Maternal-Fetal Medicine (SMFM)—and a pregnant woman filed a lawsuit against HHS and Kennedy in the U.S. District Court for the District of Massachusetts, alleging that they intentionally removed vaccines and unjustly removed the Centers for Disease Control and Prevention’s entire vaccine advisory panel.The legal action seeks preliminary and permanent injunctions to stop Kennedy’s new COVID vaccine recommendations and a declaratory judgment declaring the decision unlawful.Jack Phillips and Zachary Stieber contributed to this report. Tyler DurdenSun, 08/03/2025 - 22:10

The following slide deck was published by MGP Ingredients, Inc.

Alex Holmes of EIU says tariff frontloading and no fundamental increase in U.S. demand may lead to a weakening trade in Asia. He also says the Trump administration's tariffs may damage the very companies it's trying to protect due to higher production costs.

Oil prices slipped in early Asian trading on Monday as OPEC+ confirmed another substantial production increase for September, continuing its rapid unwinding of voluntary output cuts despite tepid demand growth in Asia. Brent crude futures fell 0.46% to $69.35 a barrel, while U.S. West Texas Intermediate declined 0.45% to $67.03. Both benchmarks had already lost roughly $2 per barrel in the previous session. The decline followed OPEC+’s announcement that it would boost production by 547,000 barrels per day (bpd) in September. This follows...

SHANGHAI, Aug. 3, 2025 /PRNewswire/ -- From March 29th to April 3rd, 2026, Tourism Plus Shanghai (TPS 2026) will convene over 6,000 global exhibitors in Shanghai, China, showcasing comprehensive solutions across the tourism and lifestyle sectors — spanning catering, accommodation,...

Employees at three of the company’s U.S. facilities voted to reject a modified four-year labour agreement, their union says

Performant Healthcare agreed to being acquired by privately owned Machinify for $7.75 per share in cash. Read why I am downgrading PHLT stock from Buy to Hold.

HIGHLIGHTS:New step-out holes drilled at Icon targeting a large gap under previous drilling returned thick, high-grade gold, confirming mineralisation continuity and significant potential for resource growth. All holes ending in mineralisation, significant intercepts include:154m at 1.1g/t gold from 76m including 5m at 22g/t gold (25GLR_062)134m at 1g/t gold from 66m...

MACOM Technology Solutions shows strong revenue growth, but high valuation and limited margin expansion temper upside potential. See why MTSI stock is a hold.

Argent Trust Co lifted its holdings in The Home Depot, Inc. (NYSE:HD – Free Report) by 0.8% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 99,592 shares of the home improvement retailer’s stock after purchasing an additional 813 [...]

Bank of Nova Scotia Trust Co. increased its holdings in shares of Pfizer Inc. (NYSE:PFE – Free Report) by 6.4% during the first quarter, HoldingsChannel reports. The firm owned 8,249 shares of the biopharmaceutical company’s stock after buying an additional 496 shares during the period. Bank of Nova Scotia Trust Co.’s holdings in Pfizer were [...]

Argent Trust Co boosted its stake in shares of QUALCOMM Incorporated (NASDAQ:QCOM – Free Report) by 2.4% in the first quarter, HoldingsChannel reports. The firm owned 88,466 shares of the wireless technology company’s stock after purchasing an additional 2,058 shares during the quarter. Argent Trust Co’s holdings in QUALCOMM were worth $13,589,000 as of its [...]

Chevron (NYSE:CVX – Get Free Report) released its earnings results on Friday. The oil and gas company reported $1.77 earnings per share for the quarter, beating the consensus estimate of $1.58 by $0.19, Zacks reports. Chevron had a net margin of 7.76% and a return on equity of 10.73%. The business had revenue of $44.82 [...]

Argent Trust Co lessened its position in Lockheed Martin Corporation (NYSE:LMT – Free Report) by 1.6% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 36,453 shares of the aerospace company’s stock after selling 603 shares during the period. Argent Trust Co’s holdings in Lockheed Martin were worth [...]

Generali Investments Towarzystwo Funduszy Inwestycyjnych decreased its position in shares of Deere & Company (NYSE:DE – Free Report) by 32.7% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,750 shares of the industrial products company’s stock after [...]

Bank of Nova Scotia Trust Co. raised its holdings in Pfizer Inc. (NYSE:PFE – Free Report) by 6.4% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 8,249 shares of the biopharmaceutical company’s stock after acquiring an additional 496 shares during the [...]

Argent Trust Co increased its holdings in shares of Chevron Corporation (NYSE:CVX – Free Report) by 0.2% during the 1st quarter, Holdings Channel.com reports. The fund owned 186,077 shares of the oil and gas company’s stock after buying an additional 279 shares during the period. Chevron makes up approximately 1.3% of Argent Trust Co’s portfolio, [...]

Chevron (NYSE:CVX – Get Free Report) posted its quarterly earnings results on Friday. The oil and gas company reported $1.77 EPS for the quarter, beating analysts’ consensus estimates of $1.58 by $0.19, Zacks reports. The business had revenue of $44.82 billion during the quarter, compared to the consensus estimate of $44.59 billion. Chevron had a [...]

Argent Trust Co boosted its position in Chevron Corporation (NYSE:CVX – Free Report) by 0.2% in the 1st quarter, according to its most recent filing with the SEC. The firm owned 186,077 shares of the oil and gas company’s stock after acquiring an additional 279 shares during the period. Chevron comprises approximately 1.3% of Argent [...]

Argent Trust Co lessened its holdings in Colgate-Palmolive Company (NYSE:CL – Free Report) by 0.7% during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 143,074 shares of the company’s stock after selling 1,055 shares during the period. Argent Trust Co’s holdings in Colgate-Palmolive [...]

ServiceNow achieves strong growth but faces high valuation risks amid market shifts. Explore its challenges, including AI impact on pricing.

Explore top 100x crypto picks like Troller Cat with 69% APY, deflationary tokenomics, and referral bonuses in the latest meme coin presale craze of 2025.

Despite cyclical headwinds and falling margins, Lennar maintains strong cash flow, low debt, and attractive valuation at 12.6x FWD P/E, cheaper than peers.

J. Safra Sarasin Holding AG lifted its stake in The Progressive Corporation (NYSE:PGR – Free Report) by 3.0% in the 1st quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 15,077 shares of the insurance provider’s stock after purchasing an additional 446 shares [...]

How Much Power Do Data Centers Use? Visual CapitalistStonepeak: ‘Power scarcity gave data centres their moat’ Infrastructure Investor

Banco Santander S.A. boosted its stake in Intuit Inc. (NASDAQ:INTU – Free Report) by 81.4% in the first quarter, Holdings Channel.com reports. The fund owned 7,516 shares of the software maker’s stock after buying an additional 3,372 shares during the quarter. Banco Santander S.A.’s holdings in Intuit were worth $4,615,000 as of its most recent [...]

Scotia Capital Inc. lessened its stake in shares of Broadcom Inc. (NASDAQ:AVGO – Free Report) by 9.0% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 451,251 shares of the semiconductor manufacturer’s stock after selling 44,450 shares during the [...]

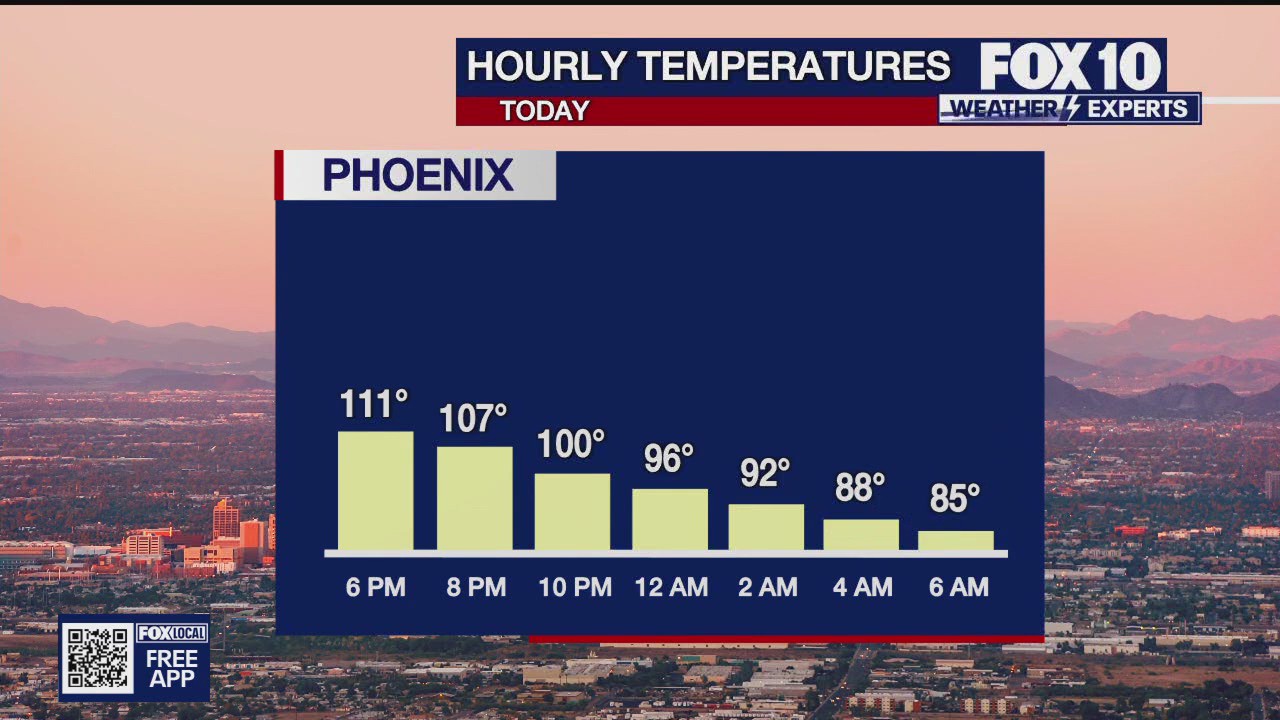

The first weekend of August is off to a hot start with record-breaking temperatures.

'No One Is Above The Law': Jack Smith Under Investigation Over Hatch Act Violations The Office of Special Counsel (OSC) has launched an investigation into Jack Smith, a DOJ lawyer who led two criminal investigations into President Donald Trump during the Biden administration - one, into Trump's handling of classified documents, and the other, which sought to prove that Trump's actions on Jan. 6, 2021 were an attempt to overturn the 2020 election. Both cases were ultimately tossed. According to an email reviewed by the NY Post, Smith is being investigated by the Hatch Act Unit, which enforces a law that restricts government employees from engaging in political activities. The email was written by Senior Counsel Charles Baldis at OSC. "I appreciate the Office of Special Counsel taking this seriously and launching an investigation into Jack Smith’s conduct. No one is above the law," Sen. Tom Cotton (R-AK) said in a statement to The Post. "Jack Smith’s actions were clearly driven to hurt President Trump’s election, and Smith should be held fully accountable."OSC launched the investigation following a letter from Cotton which accused Smith of taking blatantly political actions to undermine President Trump during his 2024 White House run. Smith notably resigned from his post as Special Counsel in January, after President Trump's inauguration. Smith’s actions as prosecutor have been widely criticized by Republicans who saw the prosecutions as an effort to weaponize the justice system against Trump and hobble his election chances in 2024.In his letter to OSC, Cotton explains how Smith’s actions undermined Trump’s political efforts.“Jack Smith’s legal actions were nothing more than a tool for the Biden and Harris campaigns. This isn’t just unethical, it is very likely illegal campaign activity from a public office,” Cotton said. “Many of Smith’s legal actions seem to have no rationale except for an attempt to affect the 2024 election results – actions that would violate federal law.”"These actions were not standard, necessary, or justified," Cotton wrote. "They were the actions of a political actor masquerading as a public official."Smith, meanwhile, has been mum on the allegations - though he has maintained that during his time as Special Counsel he followed legal protocols and was untainted by political influence (lol). Tyler DurdenSat, 08/02/2025 - 22:45

Western Digital's disciplined supply management and stable pricing have driven healthy gross margins. Read why WDC stock remains a Buy.

Saudi Arabia, Russia and six other key members of the OPEC+ alliance are expected to further hike oil production in a meeting Sunday, a move analysts say is aimed at regaining market share amid resilient crude prices.

By AUDREY McAVOY Associated Press The Corporation for Public Broadcasting, which helps pay for PBS, NPR, 1,500 local radio and television stations as well as programs like “Sesame Street” and “Finding Your Roots,” said Friday that it would close after the U.S. government withdrew funding. The organization told employees that most staff positions will endThe post Not just Big Bird: Things to know about the Corporation for Public Broadcasting and its funding cuts appeared first on News-Press NOW.

XRP eyes 20% surge in August, crypto returns to US: Hodler’s Digest, July 27 – Aug. 2 CointelegraphSEC debuts 'Project Crypto' to bring U.S. financial markets 'on chain' CNBCSEC Launches ‘Project Crypto’ To Make US The Global Hub For Bitcoin And Digital Assets Bitcoin MagazineSEC’s Crypto Task Force Will Tour U.S. to Hear From Small Startups on Policy Reform CoinDeskUS securities regulator lays out sweeping plans to accommodate crypto Reuters

Indians & Nepalese Are The World's Most Voracious Mobile Data Users With smartphones now central tools in our daily lives, mobile data usage has surged globally - especially in rural and developing countries where mobile networks often serve as the primary way to access the internet.This graphic, via Visual Capitalist's Kayla Zhu, visualizes mobile data traffic per smartphone in 2024 in GBs per month.Data comes from Ericsson’s June 2025 Mobility Report. India, Nepal, and Bhutan are not part of South East Asia and Oceania data.Which Countries Have the Highest Mobile Data Usage Rates?Below, we show mobile data traffic per smartphone in 2024 in GBs per month, by region.The region of India, Nepal, and Bhutan leads globally, with the highest data traffic per smartphone at 32 GB per monthly, nearly 50% more than North America or Western Europe.India in particular has some of the lowest mobile data costs globally, thanks to intense competition among telecom providers like Reliance Jio and Airtel.Additionally, in many rural areas, smartphones are the primary, if not only, way people access the internet. In Nepal, 96% of residents access the internet through mobile devices, while only about 15% of households have devices such as computers or laptops.Advanced regions like North America, Western Europe, and North East Asia see similar monthly usage levels, around 20 to 22 GB per phone.Sub-Saharan Africa lags behind, with the lowest data traffic at just 5 GB per month, highlighting a significant digital usage gap compared to other regions. The region faces higher internet and data costs relative to income, making internet access less affordable for many.To learn more about mobile data usage trends, check out this graphic that visualizes the countries with the highest monthly mobile data usage per capita. Tyler DurdenSat, 08/02/2025 - 21:35

"The flame comes out like the exhaust of a titan missile."

The Sunshine State just got brighter for Florida employers seeking to enforce non-compete agreements. On April 24, 2025, the Florida legislature passed the Contracts Honoring Opportunity, Investment, Confidentiality, and Economic Growth (CHOICE) Act (the “Act”). The Act—which took effect on July 1, 2025—significantly enhances the enforceability of both non-compete and garden leave agreements in Florida. As a result, Florida may now be the most non-compete friendly state in the nation.What Is the Act?At bottom, the Act enhances Florida employers’ ability to implement and enforce restrictive covenants agreements. Specifically, the Act increases the allowable duration of such contracts and lowers the bar for enforcement. The Act’s stated goals include encouraging “optimal levels of information sharing and training and development,” protecting confidential information and client relationships, and providing predictability.Who Is Covered?The Act applies only to certain “covered... Read the complete article here...Copyright © 2025, Sheppard Mullin Richter & Hampton LLP.

The Senate is leaving Washington Saturday night for its monthlong August recess without a deal to advance dozens of President Donald Trump’s nominees. The chamber is calling it quits after days of contentious bipartisan negotiations and Trump posting on social...

Health Canada issues recall for BChic, Chicure baby nest beds over safety risks CBC‘Stop using immediately’: Health Canada issues recall for baby nests CTV NewsThousands of baby nests sold in Canada recalled over strangulation risk Toronto Star

Think Uncle Sam Owes $37 Trillion? It's Far Worse Than That Via Brian McGlinchey at Stark RealitiesWhen asked how far the US government has plunged into the red, many fiscally-conscious Americans will tell you the national debt has reached $37 trillion. As distressing as that official number is, America’s true fiscal situation is even worse — far worse. According to a barely-publicized Treasury report, the actual grand total of Uncle Sam’s obligations is more than $151 trillion.That huge discrepancy springs from the fact that the federal government doesn’t hold itself to the same accounting standards it imposes on businesses. Rather than using accrual accounting — which recognizes expenses when they’re incurred — our Washington overlords self-servingly use simple cash accounting, only recognizing expenses when they’re paid. As a result, discourse on federal obligations solely focuses on the national debt, comprising Treasury bills, notes and bonds.Once a year, however, an obscure report delivers a more accurate version of Uncle Sam’s balance sheet. While it receives almost no attention from journalists or public officials, the Treasury Department is required to submit an annual report to Congress detailing the government’s financial condition. Critically, the 1994 law compelling this report mandates that it reflect “unfunded liabilities” — that is, commitments made without any dedicated assets or income streams to ensure they’ll be kept.Rep. Thomas Massie, who has two MIT degrees, designed and programmed a lapel pin that displays the mounting national debt in real time. (Photo: Alex Wong/Getty Images via Roll Call )One of the larger categories of those unfunded liabilities is future federal employee and veterans benefits. At the end of the 2024 fiscal year, this alone represented a $15 trillion obligation. However, by leaps and bounds, the largest unfunded liabilities spring from America’s social insurance obligations — primarily Social Security and Medicare. At fiscal-year end, these liabilities totaled a towering $105.8 trillion.Stacking these and other unfunded liabilities on top of the publicly-held national debt and other obligations, you arrive at a grand total of $151.3 trillion at the end of the 2024 fiscal year. Offsetting that by an estimated $7.9 trillion in US government commercial assets — including property, plant, equipment and purported gold holdings — a Just Facts analysis puts Uncle Sam at an overall net-negative $143 trillion.Writing at the Heartland Institute, Just Facts president James Agresti put that nearly-incomprehensible total in perspective: “$143 trillion amounts to 85% of the net wealth Americans have accumulated since the nation’s founding, estimated by the Federal Reserve to be $169 trillion. This includes all of their assets in savings, real estate, corporate stocks, private businesses, and even consumer durable goods like automobiles and furniture.”Those numbers reflected the government’s position on Sept 30, 2024. They’ve not only grown significantly worse in the intervening months, they’re deteriorating at a blistering pace even as you read this: Not even counting the unfunded liabilities that represent the biggest part of the problem, the national debt alone is increasing at something like $156 million per hour.Wrangling over the budget isn’t going to save us. Congressional debates tend to center on discretionary spending — outlays that require a vote by Congress during the appropriations process. However, America’s steady march to insolvency is driven by so-called mandatory spending, which is hardwired by previously-enacted laws.In what may be the most ominous indication that the government is on an autopilot-course for catastrophe, the proportion of total federal outlays driven by mandatory spending has more than doubled since 1965 — from 34% to 73% in 2024. It was at 71% just two years earlier, in 2022.From Manhattan Institute’s Spending, Taxes & Deficits: A Book of ChartsThe two largest examples of mandatory spending are Social Security and Medicare. Those old-age programs are now well within sight of a crisis that’s been warned about for a generation: According to the latest report from their program trustees, Social Security and Medicare trust funds are now just seven years from insolvency.While the federal government requires private-sector pension plans to maintain assets equal to the present value of future obligations, the federal government exempts itself from providing the same security to the citizens that it forces into the Social Security program. Contrary to the mythology that payroll taxes are placed in individual “accounts” held for our future benefit, that money is immediately being dished out to other people who’ve already reached the benefit-receiving phase — which is why Social Security can be reasonably compared to a Ponzi scheme.Because the ratio of taxpaying-workers to beneficiaries is in steady decline — from 5.1 in 1960 to 2.7 in 2023 — Social Security payouts have exceeded revenues for the last 15 years. As a result, the Social Security and Medicare trust funds are set to run out in 2033. Under the law governing Social Security, payouts that year will be limited to program incomes — which will translate to a sudden 23% cut in payouts.While that represents a political time bomb, don’t expect any urgency in defusing it. The eight-year countdown is short, but it’s still outside the next-election framing that drives elected officials’ actions. Those politicians know that anyone proposing a long-overdue rethinking of Social Security and Medicare will be opportunistically accused of “attacking” the programs. However, when the crisis is finally in their laps, don’t be surprised if part of their solution is to borrow money to prop up the payouts.There’s another key component of mandatory spending that isn’t counted in the national debt: interest payments on debt issued to cover past and current spending. “In total, social programs and interest on the national debt—which mainly stems from social programs—account for 75% of all federal spending,” notes Agresti.Interest payments also represent a steadily growing share of total outlays, and will total almost $1 trillion this year. Within 10 years, interest is projected to reach $2 trillion, roughly equal to the entire 2025 deficit. Last year saw a grim milestone, as interest expense surpassed spending on both defense and Medicare.From Manhattan Institute’s Spending, Taxes & Deficits: A Book of ChartsCurrent projections have interest surpassing Social Security to become the largest single expenditure by 2042, but don’t be surprised if that milestone doesn’t come sooner. The government is already descending into a vicious cycle in which mounting US debt has the buyers of that debt demanding higher interest rates in compensation for the growing risk of inflation and/or default — with those higher rates creating larger interest payouts and even more debt.Beyond mandatory-vs-discretionary, and funded-vs-unfunded, there’s an even more important but far-less-discussed classification of spending that goes to the very heart of America’s march toward financial disaster: constitutional vs unconstitutional. As I noted in the most-read article at Stark Realities, “Americans Are Fighting For Control Of Federal Powers That Shouldn’t Exist”:Today’s sprawling federal government, which involves itself in almost every aspect of daily American life, is almost entirely unconstitutional.To rattle off just a random fistful of the federal government’s unauthorized undertakings and entities — brace yourself — there is zero constitutional authority for the Social Security, Medicare, federal drug prohibitions, the Small Business Administration, crop subsidies, the Department of Labor, automotive fuel efficiency standards, climate regulations, the Federal Reserve, union regulation, housing subsidies, the Department of Agriculture, workplace regulations, the Department of Education, federal student loans, the Food and Drug Administration, food stamps, unemployment insurance or light bulb regulations. Even that sampling doesn’t begin to fully account for the scope of the unsanctioned activity.This Pandora’s box of unconstitutional endeavors was opened wide by unconscionably expansive Supreme Court interpretations of the Constitution in the 1930s. It’s no coincidence that federal spending represented a mere 3% of GDP in 1930 but soared to an economy-warping 23% by 2024.Now we find the federal government in a $143 trillion hole, a burden that comes out to $1,085,022 per US household. History suggests this will end with a government default. In the United States, that will likely occur not via an explicit repudiation of the debt, but through rampant price inflation as the Treasury and the Federal Reserve conspire to create new money out of thin air to make debt payments.From Manhattan Institute’s Spending, Taxes & Deficits: A Book of Charts“They can’t pay the debt, so they have to liquidate the debt,” said Ron Paul in a June conversation with David Lin. “They [won’t] default — they’re always going to pay something for the Treasury bills. What they’re going to do is liquidate the debt by paying it off with counterfeit money.”While the Fed-Treasury money creation scheme has been with us for a long time, the alarming trajectory of federal debt and spending point to future money-printing on a scale that will trigger hyperinflation and economic collapse. At that point, Americans will stand at a crossroads. Desperation and fear will make them susceptible to the siren song of even more authoritarianism and unconstitutional, centralized command of the economy and society than what put them in such dire straits to begin with.“People will want to be taken care of,” Paul said. “I see it as an opportunity. If people are promoting the cause of liberty and there’s chaos in the streets, we better get out there and lead the charge and say you don’t need more of what caused this. You don’t need more authoritarianism. What you need is more liberty and more peace, and that means you ought to obey the Constitution.”STARK REALITIES: Invigoratingly Unorthodox Perspectives For Intellectually Honest Readers Sign up and join thousands of free subscribers who benefit from monthly, ad-free insights * * *Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge Tyler DurdenSat, 08/02/2025 - 21:00

Bally’s Chicago will close its online portal Monday at noon, ending the opportunity for potential investors to perhaps own a piece of the city’s first casino.

This 4-day conference focuses on: – Fundamental reagent and flotation chemistry – Bubbles, froths, bubble-particle interactions – Flotation cell hydrodynamics, kinetics and [...]The post Flotation ’25 appeared first on Canadian Mining Journal.

SARATOGA – The village that calls itself “America’s most historic” will showcase its role in the birth of a then-young nation and punctuate its significance with a week-long staging of events.

The tax breaks were for Ellicott Station, a 55-unit affordable housing project, which recently restarted construction.

This article is the third in a mini-series that started when I highlighted a new Nissan Ariya someone could get for $31,000 and a new Chevy Equinox EV someone could get for $32,000 — both before incentives, before potential fuel savings, and before maintenance and repair savings. Featured here is ... [continued]The post A New Nissan Leaf For $28,000? (With Incentive) appeared first on CleanTechnica.

Bragar Eagel & Squire, P.C. Litigation Attorneys Encourage Investors Who Suffered Losses In Tempus (TEM) To Contact Him Directly To Discuss Their OptionsIf you purchased or acquired securities in Tempus between August 6, 2024 and May 27, 2025 and would like to discuss your legal rights, call Bragar Eagel & Squire partner Brandon Walker or Marion Passmore directly at (212) 355-4648.NEW YORK, Aug. 02, 2025 (GLOBE NEWSWIRE) -- Bragar Eagel & Squire, P.C., a nationally recognized stockholder rights law firm, announces that a class action lawsuit has been filed against Tempus AI, Inc. ("Tempus" or the "Company") (NASDAQ:TEM) in the United States District Court for the Northern District of Illinois on behalf of all persons and entities who purchased or otherwise acquired Tempus securities between August 6, 2024 and May 27, 2025, both dates inclusive (the "Class Period"). Investors have until August 11, 2025 to apply to the Court to be appointed as lead plaintiff in the lawsuit.Click here to participate in the action.According to the complaint, defendants failed to disclose: (1) Tempus inflated the value of contract agreements, many of which were with related parties, ...Full story available on Benzinga.com

Bragar Eagel & Squire, P.C. Litigation Attorneys Encourage Investors Who Suffered Losses In Tempus (TEM) To Contact Him Directly To Discuss Their Options

Trump’s tariff delay signals strategic carve-outs as AI-driven layoffs and rate cut hopes boost bullish sentiment. See why this is a strong buy opportunity now.

Top 4 meme coins for long-term gains in 2025, featuring Troller Cat’s 2024.8% ROI, Cheems, Sudeng, and Bone with staking, burns, and strong communities.

OVERSEA CHINESE BANKING Corp Ltd decreased its stake in shares of Lam Research Corporation (NASDAQ:LRCX – Free Report) by 19.6% during the 1st quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 84,574 shares of the semiconductor company’s stock after selling 20,630 shares during the quarter. OVERSEA [...]

Foundations Investment Advisors LLC cut its stake in shares of GSK PLC Sponsored ADR (NYSE:GSK – Free Report) by 9.1% in the first quarter, according to its most recent disclosure with the SEC. The firm owned 10,650 shares of the pharmaceutical company’s stock after selling 1,067 shares during the period. Foundations Investment Advisors LLC’s holdings [...]

Cumberland Partners Ltd raised its position in Eli Lilly and Company (NYSE:LLY – Free Report) by 51.4% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 35,229 shares of the company’s stock after buying an additional 11,956 shares during the [...]

Fiduciary Wealth Partners LLC purchased a new position in Eli Lilly and Company (NYSE:LLY – Free Report) during the 1st quarter, according to the company in its most recent filing with the SEC. The institutional investor purchased 264 shares of the company’s stock, valued at approximately $218,000. Several other hedge funds and other institutional investors [...]

Mirabaud & Cie SA lowered its holdings in Danaher Corporation (NYSE:DHR – Free Report) by 1.0% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 5,232 shares of the conglomerate’s stock after selling 55 shares during the period. Mirabaud & Cie SA’s holdings [...]

Baker Avenue Asset Management LP boosted its position in shares of Abbott Laboratories (NYSE:ABT – Free Report) by 18.7% during the first quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 10,188 shares of the healthcare product maker’s stock after buying an additional 1,608 shares during the [...]

Cumberland Partners Ltd lowered its position in shares of Danaher Corporation (NYSE:DHR – Free Report) by 2.5% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 14,626 shares of the conglomerate’s stock after selling 381 shares during the quarter. Cumberland Partners Ltd’s holdings [...]

Cumberland Partners Ltd reduced its holdings in shares of Carrier Global Corporation (NYSE:CARR – Free Report) by 66.2% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 22,095 shares of the company’s stock after selling 43,370 shares during the quarter. Cumberland Partners Ltd’s [...]

Bristol-Myers Squibb's sales are stabilizing, with Q2 net sales up 1% YoY and growth portfolio drugs like Camzyos and Breyanzi showing strong momentum.

Representative Jefferson Shreve (R-Indiana) recently sold shares of Arista Networks, Inc. (NYSE:ANET). In a filing disclosed on June 22nd, the Representative disclosed that they had sold between $50,001 and $100,000 in Arista Networks stock on May 12th. The trade occurred in the Representative’s “CRT – STANDARD UNIT TRUST” account. Representative Jefferson Shreve also recently made [...]

Blueshift Asset Management LLC acquired a new position in shares of Arista Networks, Inc. (NYSE:ANET – Free Report) in the first quarter, according to the company in its most recent filing with the SEC. The firm acquired 7,079 shares of the technology company’s stock, valued at approximately $548,000. A number of other institutional investors have [...]

Mackenzie Financial Corp decreased its position in shares of Sempra Energy (NYSE:SRE – Free Report) by 85.6% during the 1st quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 71,193 shares of the utilities provider’s stock after selling 422,578 shares during the quarter. Mackenzie Financial Corp’s holdings [...]