2025-08-06

Aura Announces Q2 2025 and H1 2025 Financial and Operational Results

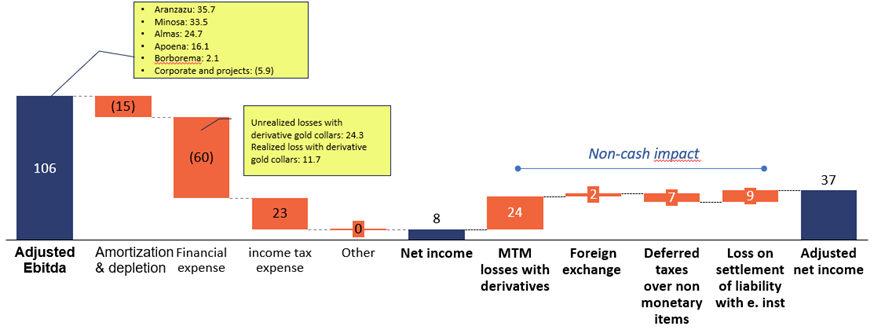

ROAD TOWN, British Virgin Islands, Aug. 05, 2025 (GLOBE NEWSWIRE) -- Aura Minerals Inc. (NASDAQ:AUGO) (TSX:ORA) (B3: AURA33) ("Aura" or the "Company") announces that it has filed its audited consolidated financial statements and management discussion and analysis (together, "Financial and Operational Results") for the period ended June 30, 2025. The full version of the Financial and Operational Results can be viewed on the Company's website at www.auraminerals.com, on SEDAR+ at www.sedarplus.ca. or on SEC www.sec.gov."In Q2, we achieved another record-high Adjusted EBITDA of US$106 million, driven by higher production and gold price of US$3,185 / Oz, bringing our last twelve months (LTM) Adjusted EBITDA to US$344 million at an average gold price of US$2,812 / Oz. Additionally, Aura reached significant milestones, including the publication of the Preliminary Economic Assessment (PEA) for Era Dorada, the signing of a purchase agreement for MSG, and a successful IPO on Nasdaq. We also approved our quarterly dividend payment, delivering a 7.4% yield return to our shareholders over the LTM, inclusive of share buybacks. Looking ahead, we expect commercial production at Borborema, the completion of the MSG acquisition in Q3, and to meet our production and cost guidance for the year." Commented Rodrigo Barbosa President and CEO of Aura.Operational & Financial Headlines Q2 2025 and H1 2025 (US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Total Production (GEO)64,033 60,087 7%64,327 -0%124,120 132,514 -6%Total Sales (GEO)62,452 60,491 3%63,258 -1%122,943 132,344 -7% Net Revenue190,436 161,804 18%134,411 42%352,240 266,489 32%Gross Profit103,939 78,428 33%51,308 103%182,367 97,989 86%Gross Margin55%48%6 p.p.38%16 p.p.52%37%15 p.p.EBITDA106,224 81,479 30%53,208 100%187,703 109,398 72%EBITDA Margin56%50%542 p.p.40%1619 p.p.53%41%1224 p.p.Net Income8,147 (73,249)n.a.(25,775)-132%(65,102)(34,992)n.a.Net Income Margin4%-45%n.a.-19%-122%-18%-13%n.a.Adjusted Net Income136,834 26,903 37%9,414 291%63,737 22,980 177%Adjusted Net Income Margin19%17%3 p.p.7%176%18%9%9 p.p.Cash Cost (US$/GEO)1,146 1,149 -0%1,080 6%- 1,040 -100%All In Sustaining cost (US$/GEO)1,449 1,461 -1%1,328 9%1,455 1,307 11% Operating Cash Flow60,420 41,229 47%53,612 13%83,867 79,464 6%Net Debt/LTM EBITDA0.8x0.9x-0.1x0.8x0.0x0.8x0.8x0.0xCAPEX50,327 51,725 -3%23,575 113%102,052 53,278 92%1. Adjusted Net Income of Q1 2025 does not consider deffered taxes over non-monetary items. Except as otherwise noted in this document, references herein to "US$" or and "$" are to thousands of United States dollarsHeadlinesTotal production in Q2 2025 reached 64,033 gold equivalent ounces ("GEO"), 7% higher than Q1 2025 and in line compared to the same period last year at current metal prices. At constant metal prices, production increased by 9% when compared to both Q1 2025 and Q2 2024. During the quarter, Aura commenced operations at Borborema — anticipated to be one of the Company's largest and lowest cash cost operations. In H1 2025, production was 124,120 GEO an increase when compared to the result of H1 2024 of 122,680 GEO, at constant prices. Compared to the public guidance for 2025, this total production represents 47% of the low proposed guidance and 41% of the high proposed guidance, reinforcing the Company's confidence in meeting the 2025 production guidance, since Borborema is still in the ramp up phase.Sales volumes was 62,452 in GEO this quarter, a decrease by 1% in Q2 2025 from Q2 2024 and increased by 3% when compared to the previous quarter. This result in the quarter was in line with Aura's expectation, reflecting Apoena mine's investment phase and also due to lower sales volumes at Aranzazu, considering the negative impact of the copper to gold conversion (despite the total sale copper was 16,815 Klb, a 30% increase compared to Q2 2024 and 23% higher than Q1 2025) and Minosa, all partially offset by the preliminary production of Borborema and higher sales volumes at Almas. Compared to the same period of 2024, sales decreased mainly due to lower production at Minosa and Apoena, gold prices that negatively impacted GEO conversion at Arazanzu. In H1 2025, sales volumes decreased by 7%, mainly due to lower sales volumes at Aranzazu (due to GEO conversion), Apoena and Minosa.Net Revenues reached a record high of US$190,436 in Q2 2025, representing an increase of 42% compared to Q2 2024 and an increase of 18% when compared to Q1 2025, mainly due to higher gold price. In H1 2025, revenues reached US$352,240, an increase of 32% compared to the same period of 2024.Average net realized gold sale prices increased by 14% in Q2 2025 compared to Q1 2025, with an average of US$3,185/oz in the quarter. Compared to Q2 2024, average net realized gold sale prices increased 44% (US$2,208). In H1 2025, average net realized gold sale prices reached US$2,986, a 42% increase when compared to H1 2024.Average realized copper sale prices increased 5% compared to Q1 2025, with an average of US$4.46/lb in the quarter, and were in line with the same period in 2024. In H1 2025, average copper sale prices reached US$4.36, a 5% increase when compared to H1 2024.Adjusted EBITDA reached another record high of US$106,224 in Q2 2025, marking the fourth consecutive quarterly record reported by Aura. The increase was driven by a combination of higher gold prices, cash costs under control and increase in sales in Q2 2025 compared to Q1 2025. When compared to Q2 2024, Adjusted EBITDA reached a 90% increase.AISC for Q2 2025 was US$1,449/GEO, a decrease by 1% when compared to Q1 2025 (US$1,461/GEO) and an increase of 9% over the Q2 2024, in line with the Company's expectations. At constant Q2 2024 metal prices, AISC would have been US$1,312 in the quarter, a decrease of 1% compared to Q2 2024, due to lower AISC at Almas, Aranzazu (at constant prices) and Apoena.The Company's Net Debt reached US$280,560 by Q2 2025, due to capex of US$50.3 million, mostly related to the final phase of construction of the Borborema Project, dividends of US$29.8 million, annual income taxes paid of US$29.5 million and reduction of US$13.7 million in debt due to the settlement of Nemesia SARL debt related to the Bluestone acquisition. The net debt-to-last 12 months EBITDA ratio reduced to 0.8x at the end of Q2 2025, from 0.9x at the end of Q1 2025.OTHER UPDATES:U.S. Public Offering: In July 2025, Aura concluded its U.S. Initial Public Offering ("IPO") of 8,100,510 common shares, at a public offering price of US$24.25 per common share. Aura raised around US$196 million. The common shares were listed on the Nasdaq Global Select Market under the ticker symbol "AUGO" and began trading on July 16, 2025. The U.S. listing is part of Aura's strategy to unlock value for our shareholders, improve liquidity of its common shares, as well as strengthen and diversify its shareholder base through broader access to global capital markets.Borborema Ramp-Up and First once sold: Borborema Project ("Borborema") started its ramp-up phase on schedule and on budget, with the mine and plant currently in operation, and it produced in Q2 2025 totaled 2,577 GEO following the project's first gold pour. Borborema is poised to become a cornerstone asset for Aura, anticipated to deliver the second highest annual gold production among the Company's five operating mines. Built in just 19 months with zero lost time incidents, the project exemplifies Aura's commitment to developing simple, scalable, and efficient operations. It also sets a benchmark in ESG performance, incorporating renewable energy sources and utilizing grey water from the local municipality. Aura believes that Borborema remains on track to declare commercial production by the end of Q3 2025.Acquisition of MSG (Mineração Serra Grande Gold) Mine in Goiás, Brazil: In June 2025, Aura announced the acquisition from AngloGold all of the issued and outstanding securities of Mineração Serra Grande S.A. ("MSG"), owner of the MSG gold mine located in Crixás, in the state of Goiás, Brazil. In consideration for the acquisition of MSG, Aura will pay to AngloGold: (i) an upfront cash consideration of US$ 76 million on closing subject to certain working capital adjustments as at the closing date; plus (ii) deferred consideration payments equivalent to a 3% net smelter returns participation over the currently identified Mineral Resource of MSG (inclusive of the Mineral Reserve) payable quarterly. The Transaction excludes certain current subsidiaries of MSG, which hold assets that do not form part of MSG's mining operations or Mineral Resources and Mineral Reserves. These subsidiaries will be spun off from MSG prior to the closing of the Transaction. The closing of the Transaction is expected to happen by Q3 2025, and no later than Q4 2025.Preliminary Economic Assessment for the Era Dorada Project: In June 2025, Aura filed a Preliminary Economic Assessment ("PEA") for the Company's wholly owned Era Dorada Project, in the United States in accordance with S-K 1300 and NI 43.101. The PEA indicated Mineral Resources of 1.9 million ounces of gold, assuming 6.35 million tonnes at 9.31 grams per tonne. The total production of approximately 1.4 million ounces of gold over a 17 years Life of Mine ("LOM"), and with average production of 91k ounces of gold for the first 4 years. Regarding CAPEX, the PEA presented a total initial implementation capex of approximately US$264 million with a payback in approximately 3.5 years after the beginning of the operation.Exercise of Options to Acquire 100% of the Pé Quente and Carajás ProjectsAura has exercised its options to acquire 100% ownership of the Pé Quente and Carajás Projects in Brazil, as previously announced in press releases dated February 27, 2023 and May 22, 2024. These transactions reinforce Aura's commitment to growing its resource base and exploration and development pipeline across key jurisdictions in the Americas.Pé Quente Project100% ownership secured;16,942m of drilling completed confirming mineralization across four targets;Continuity confirmed with strike lengths up to 440m and down-dip extents up to 350m in the Nilva target;Preliminary Meturlligcal testing planned for second semester of 2025 to support potential resource and life of mine expansion for the Matupá Project, located within a 50km radius.Aura Carajás ProjectFinal US$3M payment completed to fully acquire the project;Approximately 10,000 meters of drilling planned at Carajás in H2 2025 to support advancement; toward a maiden resource in Serra da Estrela target.Investment in Altamira Gold Corp. through a Private Placement: In July 2025, Aura entered into a subscription agreement with Altamira Gold Corp., acquiring 6,000,000 units at C$0.10 per unit in a non-brokered private placement, totaling C$600,000. Each unit comprises one common share and one-half of a share purchase warrant, exercisable at C$0.15 per share until June 30, 2027. Prior to this, Aura held 24,000,000 shares and 24,000,000 warrants (11.3% non-diluted, 20.3% fully diluted, as per November 2023). Post-transaction, Aura holds 30,000,000 shares and 27,000,000 warrants (11.3% non-diluted, 19.5% fully diluted). The units were acquired directly from Altamira for investment purposes due to its exploration potential.Results Teleconference:Date: August 6, 2025Time: 10 a.m. (Brasília) | 9 a.m. (New York and Toronto)Link to access: Click here2. Consolidated Financial Results2.1 Total Production and Sales (GEO)English (GEO)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Production64,033 60,087 7%64,327 -0%124,120 132,514 -6%Aranzazu22,281 20,456 9%24,692 -10%42,737 49,693 -14%Apoena8,219 8,876 -7%9,912 -17%17,095 22,017 -22%Minosa18,039 17,654 2%19,142 -6%35,693 38,328 -7%Almas12,917 13,101 -1%10,580 22%26,018 22,475 16%Borborema2,577 0 n.a.0%n.a.257700%0%n.a.(GEO)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Sales62,452 60,491 3%63,258 -1%122,943 132,344 -7%Aranzazu22,290 20,456 9%24,683 -10%42,746 49,786 -14%Apoena8,219 9,408 -13%8,258 -0%17,627 21,118 -17%Minosa17,836 17,526 2%19,738 -10%35,362 38,966 -9%Almas12,917 13,101 -1%10,580 22%26,018 22,475 16%Borborema1,190 0 n.a.0 n.a.1,190 0 n.a.Applies the metal sale prices in Aranzazu realized during Q2 2025: Copper price = US$4.39/lb; Gold Price = US$3,293/oz; Silver Price = US$34.27/oz.Total production in Q2 2025 reached 64,033 gold equivalent ounces ("GEO"), 7% higher than Q1 2025 and in line compared to the same period last year at current metal prices, mainly due to negative impact from the copper-to-GEO conversion at Aranzazu. At constant metal prices, production increased by 9% when compared to both Q1 2025 and Q2 2024. The result was mainly attributable to stronger operational performance at Aranzazu, which posted higher metallurgical recoveries and improved head grades for all metals, on both an annual and quarterly basisDuring the quarter, Aura commenced operations at Borborema — anticipated to be one of the Company's largest and lowest cash cost operations. In the quarter, Borborema's preliminary production totaled 2,577 GEO, following the project's first gold pour. The project was completed on schedule, within 19 months, and on budget and Aura expects to achieve to declare Borborema commercial production by the end of Q3 2025.In the first half of 2025, production reached 124,120 GEO, representing a 6% decline at current metal prices. At constant prices — which neutralize the effect of copper price fluctuations in the GEO conversion at Aranzazu — this reflects an increase over the 122,259 GEO produced in H1 2024. . At current metal prices, production in Q2 2025 was consistent with Q2 2024, and year-to-date production represents 47% of the lower end and 41% of the upper end of the full-year guidance. This performance reinforces the Company's confidence in meeting its 2025 targets, especially considering that Borborema is still in the ramp-up phase. Excluding Borborema, total production to date accounts for 52% of the lower bound and 47% of the upper bound of the guidance range.2.2. Net Revenue(US$ thousand)Q2 2025Q1 2025% Q2 2024% H1 2025H1 2024% Aranzazu62,50850,26224%49,24027%112,77093,40221%Apoena26,71126,3531%18,99241%53,06444,99918%Minosa55,77648,06216%41,96233%103,83879,60930%Almas41,75137,12712%24,21772%78,87848,47963%Borborema3,690-n.a-n.a3,690-n.a.Total190,436161,80418%134,41142%352,240266,48932% In Q2 2025, the Company reported Net Revenue of US$190.4 million, representing a 42% increase year-over-year and an 18% increase compared to Q1 2025. The strong performance was primarily driven by the higher metal prices, particularly gold, with the average realized gold price increasing by 44%, from US$2,208/oz in Q2 2024 to US$3,185/oz in Q2 2025. Copper prices also contributed positively, with the average realized copper price increasing by 5%, from US$4.26/lb in Q2 2024 to US$4.46/lb in Q2 2025.With this result, Net Revenues reached US$352,240 in H1 2025, an increase of 32% when compared to the same period of 2024. The result was mainly driven by higher gold prices, higher sales at Almas and the start of the Borborema Project. In H1 2025, average net realized prices reached US$2,986, a 42% increase when compared to H2 2024; and average copper prices reached US$4.36/lb, a 5% increase when compared to H2 2024.2.3. Cash Cost and All in Sustaining Costs(US$/GEO)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Cash Cost1,146 1,149 -0%1,080 6%1,147 1,040 10%Aranzazu1,110 1,164 -5%958 16%1,136 942 21%Apoena1,168 1,228 -5%1,252 -7%1,200 940 28%Minosa1,178 1,149 3%1,094 8%1,164 1,140 2%Almas1,167 1,069 9%1,203 -3%1,118 1,176 -5%Borborema936 0 n.a.0 n.a.936 - n.a. All-in Sustaining Cost1,449 1,461 -1%1,328 9%1,455 1,307 11%Aranzazu1,514 1,545 -2%1,206 26%1,529 1,235 24%Apoena1,751 2,041 -14%1,958 -11%1,906 1,500 27%Minosa1,292 1,249 3%1,159 12%1,271 1,223 4%Almas1,364 1,195 14%1,434 -5%1,279 1,428 -10%Borborema1,441 0 n.a.0 n.a.1,441 - n.a.For the second quarter of 2025, the Company's Cash Cost was US$1,146/GEO, an increase of 6% over Q2 2024 and in line with Q1 2025, even with the preliminary production of Borborema. Year-on-year, the increase in cash cost was mainly attributed to the increase in costs at Aranzazu, mainly due to impact from the copper-to-GEO conversion in production. At constant Q2 2024 metal prices, Cash Costs decreased by 4%. Quarter-over-quarter, cost improvements at Aranzazu and Apoena were sufficient to offset higher costs at Almas, which faced a decrease in grades as anticipated in the mine sequencing plan.In H1 2025, Cash Cost averaged US$1,147/oz, representing a 10% increase compared to the same period in 2024, the increase was primarily driven by the impact of the copper-to-GEO conversion at Aranzazu and lower production at Apoena, as expected. At constant H1 2024 metal prices, Cash Costs increased by 2%The consolidated All-in Sustaining Cost (AISC) was US$1,449 per GEO, representing a 9% increase compared to Q2 2024 and a 1% decrease versus Q1 2025, in line with the cash cost trend. When calculated using constant metal prices from Q2 2024, AISC for the quarter would have been US$1,312 per GEO, a decrease of 1%. In H1 2025, AISC was US$1,455, a 11% increase compared to H1 2024. At constant H1 2024 metal prices, AISC increased by 3%.2.4. Gross Income (US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Net Revenue190,436 161,804 18%134,411 42%352,240 266,489 32%Cost of goods sold(86,497)(83,376)4%(83,103)4%(169,873)(168,500)1%Cost of production(44,470)(44,919)-1%(36,203)23%(89,389)(75,062)19%Cost of production - Contractors(17,529)(15,467)13%(22,356)-22%(32,996)(42,380)-22%Change in inventory (cash)(9,550)(9,126)5%(9,762)-2%(18,676)(20,167)-7%Depreciation and amortization(14,948)(13,864)8%(14,782)1%(28,812)(30,891)-7%Gross Profit103,939 78,428 33%51,308 103%182,368 97,989 86%Gross Margin55%48%6 p.p.38%1641 p.p.52%37%15 p.p.The increase in Net Revenue coupled with the Company's rigorous cost control – with an increase of 4% on Cost of goods sold compared to the same quarter of 2024 – led to a Gross Profit at the quarter of US$130.9 million in Q2 2025, with a Gross Margin of 55%, compared to the Gross Profit of US$51.3 million in Q2 2024 and US$78.4 million in Q1 2025.In H1 2025, Gross Profit reached US$182.4 million, higher than US$98.0 million in H1 2024, also explained by 32% increase in net revenue and only 1% at costs of goods sold.2.5.Operating Expenses(US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Gross Profit103,939 78,428 33%51,308 103%182,367 97,989 86%Operational Expenses(12,998)(11,012)18%(10,482)24%(24,010)(20,703)16%General and administrative expenses(11,284)(9,636)17%(7,156)58%(20,920)(15,014)39%Care-and-maintenance expenses- - n.a.(375)n.a.- (796)n.a.Exploration expenses(1,714)(1,376)25%(2,951)-42%(3,090)(4,893)-37%Operating income90,941 67,416 35%40,826 123%158,357 77,286 105% Operating Expenses totaled US$13.0 million in the quarter, 18% higher than Q1 2025 and 24% higher than Q2 2024. The result for the quarter was mainly impacted by higher General & Administrative (G&A) expenses, driven by increased professional and consulting fees, as well as audit cost adjustments primarily related to the Company's U.S. listing. In H1 2025, there was a 16% increase in Operational Expenses due to a 39% increase in G&A, partially offset by a 37% reduction in Exploration Expenses.Exploration expenses totaled US$1.7 million in Q2 2025, a 25% increase compared to Q1 2025 and 42% reduction from Q2 2024. Exploration activities in the quarter were concentrated in Almas and Minosa. In Matupá, efforts were focused on expanding reserves in regions close to X1, Pé Quente and other strategic areas. In Carajás, exploration work successfully confirmed copper mineralization, significantly expanding the mineral potential of the region. In H1 2025, the reduction of the Q2 2025 partially compensated the higher expenses in Q1 2025, closing the semester with a 37% reduction, in line with the Company's plan and due to the capitalization of exploration expenses in certain targets.The Company thus ended Q2 2025 with Operating Income of US$90.9 million, compared to an Operating Income of US$40.8 million in Q2 2024, also higher compared to the Operating Income of Q1 2025 of US$67.4 million, which reflects a positive result of higher gross profit.2.6. Adjusted EBITDA(US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Operating Income90,941 67,416 35%40,826 123%158,357 77,286 105%Depreciation and Amortization15,283 14,063 9%15,346 -0%29,346 31,553 -7%Adjusted EBITDA106,224 81,479 30%56,172 89%187,703 109,398 72%Adjusted EBITDA Margin56%50%5 p.p.42%14 p.p.53%41%12 p.p.Adjusted EBITDA reached a new all-time high of US$106.2 million in Q2 2025, marking the fourth consecutive quarterly record for Aura. The Company's ongoing commitment to improving asset productivity and maintaining disciplined cost control enabled it to fully capture the benefit of rising metal prices. As a result, Adjusted EBITDA doubled compared to Q2 2024 and grew 30% over Q1 2025.The year-over-year improvement was primarily driven by strong cost control – only 4% increase - and higher gold and copper prices. This result was also noted on the EBITDA margin gain of 14 p.p. Compared to Q1 2025, the increase in Adjusted EBITDA was supported not only by stronger metal prices and also by a 3% increase in sales volume.In H1 2025, the Company maintained stable Cost of Goods Sold compared to H1 2024. Combined with the positive impact of higher metal prices, this led to an Adjusted EBITDA of US$187.7 million, a 72% increase over the same period last year. As a result, the Adjusted EBITDA margin expanded to 53%, up from 41% in H1 2024.2.7. Financial Result (US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % EBIT90,941 67,416 34.9%40,826 123%158,357 77,286 105%Financial Result(59,630)(121,611)-51.0%(45,102)32%(181,241)(79,197)129%Accretion expense(1,134)(1,666)-31.9%(1,573)-28%(2,800)(3,106)-10%Lease interest expense(161)(1,595)-89.9%(2,012)-92%(1,756)(4,021)-56%Interest expense on debts(6,098)(5,755)6.0%(4,121)48%(11,853)(8,338)42%Finance cost on post-employment benefit(747)(338)121.0%(467)60%(1,085)(834)30%Unrealized gain (loss) on gold hedges(24,304)(100,210)-75.7%(11,558)110%(124,514)(33,226)275%Realized gain (loss) on gold hedges(11,703)(6,036)93.9%- n.a.(17,739)- n.a.Gain (loss) on other derivative transactions(1,305)(1,827)-28.6%- n.a.(3,132)- n.a.Change in liability measures at fair value(4,025)(2,359)70.6%(954)322%(6,384)(3,587)78%Foreign exchange (gain) loss(2,462)(3,176)-22.5%(11,184)-78%(5,638)(13,274)-58%Derivative fee- - n.a.(13,522)n.a.- (13,522)n.a.Loss on settlement of liability with equity instruments(8,768)- n.a.- n.a.(8,768)- n.a.Other finance costs(297)(430)-30.9%(140)n.a.(727)(571)27%Interest Income1,374 1,781 -22.9%429 220%3,155 1,282 146%Other gains (losses)61 (754)n.a.1 n.a.(693)(593)17%Income/ (Loss) before income taxes31,372 (54,949)n.a.(4,275)n.a.(23,577)(2,504)842% The Company's Financial Result in Q2 2025 was US$(59.6) million, following on from the US$(121.6) million loss in Q1 2025, impacted by:Unrealized loss on gold hedges in Q2 2025, arising from mark-to-market (MTM) adjustments related to outstanding gold hedge positions, reflecting increase in gold prices between the start and the end of the quarter, which closed the quarter at US$3,288.57 per Oz, coming from US$2,861.93 per Oz on March 31, 2025. In accordance with IFRS standards, the Company records MTM adjustments at the end of each reporting period for all outstanding derivative positions.Realized losses with gold hedges in Q2 2025 were related to cash settlement of outstanding gold collars during the quarter, driven by the expiration of gold collars within the quarter.Non-cash loss of US$8.8 million related to the settlement of the Nemesia SARL debt with equity instruments, reflecting the difference between the fair value of the shares at the time when the shares were issued and the carrying amount of the debt acquired in the Bluestone transaction at the closing of the transaction.Most of Aura's outstanding gold collars (225,996 Ozs out of about 234,598 Ozs) are associated with the future production of the Borborema Project and will expire between Jul/2025 and Jun/2028. As previously disclosed, about 80% of the production of the first 3 years of the Borborema Project is hedged at ceiling prices of US$2,400.2.8. Net Income (US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Income/ (Loss) before income taxes31,372 (54,949)n.a.(4,275)n.a.(23,577)(2,504)841.6%Total taxes(23,225)(18,300)27%(21,500)8%(41,525)(32,488)28%Current income tax (expense)(29,551)(20,814)-42%(14,612)102%(50,365)(24,755)103%Deferred income tax (expense) recovery6,326 2,514 -152%(6,888)-192%8,840 (7,733)n.a.Income/(Loss) for the period8,147 (73,249)n.a.(25,775)-132%(65,102)(34,992)n.a.Net Margin4%-45%n.a.-19%-122%-18%-13%n.a.Unrealized loss with derivative gold collars(24,304)(100,210)n.a.(11,558)110%(124,514)(33,226)275%Gain (loss) on foreign exchange(2,462)(3,176)22%(11,184)-78%(5,638)(13,274)-58%Deferred taxes on non-monetary items6,847 3,234 n.a.(12,447)-155%10,081 (11,472)n.a.Loss on settlement of liability with equity instruments(8,768)- n.a.- n.a.(8,768)- n.a.Adjusted Net Income36,834 26,903 37%9,414 291%63,738 22,980 177%Net Income in Q2 2025 was US$8.1 million, an increase when compared to a Net Loss of US$(25.8) in Q2 2024 and US$(73.2) in Q1 2025. This improvement vs. Q2 2024 and Q1 2025 was mainly due to the improvement in the Operating Income during Q2 2025. In addition, compared to Q1 2025, there was a decrease in Finance Costs in the quarter, related to a lower unrealized loss on gold hedges in Q2 2025, which resulted from mark-to-market (MTM) adjustments on open hedge positions, driven by increase in gold price between the start and the end of the quarterIn H1 2025, Net Loss reached US$(65.1), also mainly due to mark-to-market (MTM) adjustments on open hedge positions, driven by increase in gold price between the start and the end of the semester.Adjusted Net IncomeAs result of increase in the Company's Operating Income, adjusted net income in Q2 2025 was US$36.8 million in the period, compared to US$9.4 million in Q2 2024, excluding:Non-cash losses related to gold hedges: US$(24.3) millionFX losses: US$(2.5) millionDeferred taxes over non-monetary items US$6.9 millionLoss on settlement of liability with equity instruments: US$(8.8) millionManagerial view – Adjusted EBITDA to Adjusted Net Income Q2 2025 Bridge (US$ million)3. Performance of the Operating Units3.1 Aranzazu(US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Production at Constant Prices (GEO)122,281 19,017 17%19,337 15%41,298 39,439 5%Production at Current Prices (GEO)22,281 20,456 9%24,692 -10%42,737 49,693 -14%Sales (GEO)22,290 20,456 9%24,683 -10%42,746 49,786 -14%Cash Cost (US$/GEO)1,110 1,164 -5%958 16%1,136 942 21%AISC (US$/GEO)1,514 1,545 -2%1,206 26%1,529 1,235 24% Net Revenue62,508 50,262 24%49,240 27%112,770 93,402 21%Cost of goods sold(31,021)(30,282)2%(29,266)6%(61,303)(58,130)5%Gross Profit31,487 19,980 58%19,974 58%51,467 35,272 46%Expenses(2,310)(2,483)-7%(2,588)-11%(4,793)(5,010)-4%G&A(1,516)(1,774)-15%(932)63%(3,290)(2,244)47%Exploration expenses(794)(709)12%(1,656)-52%(1,503)(2,766)-46%EBIT29,177 17,497 67%17,386 68%46,674 30,262 54%Adjusted EBITDA35,684 24,387 46%23,012 55%60,254 41,502 45%Financial Result(4,292)(606)608%(832)416%(4,898)(1,675)192%Financial expenses(3,762)(34)n.a.(201)n.a.(3,796)(748)407%Other revenue/expenses(530)(572)-7%(631)-16%(1,102)(927)19%EBT24,885 16,891 47%16,554 50.3%41,776 28,587 46.1%Total taxes(12,532)(7,383)70%(6,814)84%(19,915)(11,230)77%Current income tax (expense)(13,035)(6,431)n.a.(7,796)67%(19,466)(12,291)58%Deferred income tax (expense) recovery503 (952)n.a.982 -49%(449)1,061 n.a.Net Income12,353 9,508 30%9,740 27%21,861 17,357 26%Applies the metal sale prices in Aranzazu realized during Q2 2025: Copper price = US$4.39/lb; Gold Price = US$3,293/oz; Silver Price = US$34.27/oz.In the second quarter of 2025, Aranzazu production reached 22,281 GEO, representing an increase of 9%, at current prices, and 17% at constant prices, when compared to the previous quarter, resulting from higher grades and better recoveries, despite the increase in gold prices which negatively impacted the conversion to GEO. When compared to Q2 2024, production decreased by 14% due to the sharp increase in gold prices between the periods which also impacted GEO conversion. At constant prices, Aranzazu production increased by 15%, also due to higher grades and a recovery improvement.Aranzazu's Net Revenue totaled US$62.5 million for Q2 2025, 24% higher than Q1 2025. Net Revenue grew 27% compared to Q2 2024, driven by higher metal prices. In H1 2025, the Net Revenue of Aranzazu reached US$112.8 million, a 21% increase compared to H1 2024.The Cash Cost was US$1,110/GEO for the quarter, 5% lower than Q1 2025 and 16% higher than Q2 2024. In H1 2025, Cash Cost increased by 21%, with a total of US$1,136/GEO in the semester. Aranzazu`s AISC was US$1,514 in the quarter, representing a 26% increase compared to the same period last year mainly due to differences in metal prices. At constant metal prices, AISC decreased by 3% when compared to Q2 2024. The decrease in AISC versus last year is a result from higher grades and recoveries, in line with planned mine sequencing, partially offset by higher investments in primary development and tailing dams. In H1 2025, the AISC was US$1,248, an increase of 1% compared to the same period in 2024 at same metal prices.The cost discipline aligned with better productivity drove the Adjusted EBITDA to US$35.7 million in Q2 2025, 46% higher than Q1 2025 and 55% higher than Q2 2024. In H1 2025, Adjusted EBITDA reached US$60.1 million, an increase of 45% over H2 2024. Aranzazu's Net Income totaled US$12.3 million in Q2 2025, a 27% increase compared to Q2 2024, and US$21.9 million in H1 2024.3.2 Apoena(US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Production (GEO)8,219 8,876 -7%9,912 -17%17,095 22,017 -22%Sales (GEO)8,219 9,408 -13%8,258 -0%17,627 21,118 -17%Cash Cost (US$/GEO)1,168 1,228 -5%1,252 -7%1,200 940 28%AISC (US$/GEO)1,751 2,041 -14%1,958 -11%1,906 1,500 27% Net Revenue26,711 26,353 1%18,992 41%53,064 44,999 18%Cost of goods sold(14,270)(15,104)-6%(15,814)-10%(29,374)(31,749)-7%Gross Profit12,441 11,249 11%3,178 291%23,690 13,250 79%Expenses(998)(1,425)-30%(1,150)-13%(2,423)(2,175)11%G&A(936)(1,301)-28%(785)19%(2,237)(1,427)57%Care & maintenance expenses- - n.a.(243)n.a.- (578)n.a.Exploration expenses(62)(124)-50%(122)-49%(186)(170)9%ARO- 1,330 n.a.- n.a.1,330 - n.a.EBIT11,443 9,824 16%2,028 464%21,267 11,075 92%Adjusted EBITDA16,151 13,516 19%7,541 114%29,697 23,046 29%Financial Result(1,453)(6,567)-78%(2,708)-46%(8,020)(6,350)26%Financial expenses(1,497)(6,636)-77%(2,798)-46%(8,133)(6,440)26%Other revenue/expenses44 69 -36%90 n.a.113 90 26%EBT9,990 3,257 207%(680)n.a.13,247 4,725 180%Total taxes(1,211)1,342 n.a.(2,788)-57%131 (3,507)n.a.Current income tax (expense)(862)(663)30%(986)-13%(1,525)(1,882)-19%Deferred income tax (expense) recovery(349)2,005 n.a.(1,802)-81%1,656 (1,625)n.a.Net Income8,779 4,599 91%(3,468)n.a.13,378 1,218 998%In the second quarter of 2025, Apoena production was in line with expectations and at 8,219 GEO, a 17% decrease from Q2 2024, primarily due to the mine's investment phase focusing on opening the Nosde Phase III pit, and lower ore grades as result. Compared to Q1 2025, production decreased 7%, consistent with the mine plan, as lower-grade ore was mined. Despite this decrease, production remains in line with the Company' full year 2025 expectations. Pre-stripping activities are underway while we push back the Nosde and Lavrinha mines to regain access to higher volume and higher grades by end of 2026 at Nosde Phase III.Apoena's Net Revenue totaled US$26.7 million for Q2 2025, in line with Q1 2025. Compared to Q2 2024, the significant increase of 41% mainly due to the higher gold price, offsetting the lower production. In H1 2025, Apoena reached a Net Revenue of US$53.1 million, an increase of 18% compared to H1 2024.The Cash Cost was US$1,168/GEO for the quarter, a 5% decrease versus Q1 2025 and 7% lower than Q2 2024. Apoena's AISC was US$ 1,751/GEO in Q2 2025, a drop of 14% versus Q1 2025 and a decrease of 11% compared to Q2 2024, mainly driven by increase in the proportion of costs capitalized as expansion capex, related to the Nosde pit. In H1 2025, the AISC was US$1,906, an increase of 27% compared to the same period in 2024, which was expected considering the mine sequencing. Despite the ongoing investments in expansion, which have temporarily impacted production, the focus on cost control combined with higher gold prices drove Adjusted EBITDA to US$16.1 million in Q2 2025, up 114% compared to Q2 2024 and 19% higher than Q1 2025. In H1 2025, Adjusted EBITDA reached US$29.7 million, an increase of 29% over H2 2024.Apoena's net income totaled US$8.8 million in Q2 2025, a 91% increase over Q1 2025 and a significant improvement from the net loss of US$3.5 million recorded in Q2 2024 resulting in a net income of US$13.4 million in the H1 2025, an increase of 998% when compared to H1 2024.3.3 Minosa(US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 % Production (GEO)18,039 17,654 2%19,142 -6%35,693 38,328 -7%Sales (GEO)17,836 17,526 2%19,738 -10%35,362 38,966 -9%Cash Cost (US$/GEO)1,178 1,149 3%1,094 8%1,164 1,140 2%AISC (US$/GEO)1,292 1,249 3%1,159 12%1,271 1,223 4% Net Revenue55,776 48,062 16%41,962 33%103,838 79,609 30%Cost of goods sold(22,056)(21,476)3%(23,171)-5%(43,532)(47,213)-8%Gross Profit33,720 26,586 27%18,791 79%60,306 32,396 86%Expenses(1,430)(1,371)4%(1,242)15%(2,801)(2,392)17%G&A(1,166)(1,135)3%(1,242)-6%(2,301)(2,391)-4%Exploration expenses(264)(236)12%- n.a.(500)(1)n.a.EBIT32,290 25,215 28%17,549 84%57,505 30,004 92%Adjusted EBITDA33,533 26,856 25%19,120 75%60,646 32,796 85%Financial Result(1,189)(1,556)-24%(2,064)-42%(2,745)(4,426)-38%Financial expenses(1,442)(1,312)10%(1,661)-13%(2,754)(3,836)-28%Other revenue/expenses253 (244)n.a.(403)n.a.9 (590)n.a.EBT31,101 23,659 31%15,485 101%54,760 25,578 114%Total taxes(7,425)(6,218)19%(4,948)50%(13,643)(8,743)56%Current income tax (expense)(7,774)(6,611)18%(4,936)57%(14,385)(8,508)69%Deferred income tax (expense) recovery349 393 -11%(12)n.a.742 (235)n.a.Net Income23,676 17,441 36%10,537 125%41,117 16,835 144%In the second quarter of 2025, Minosa produced 18,039 GEO, up 2% when compared to the previous quarter, resulting from higher grades processed during the quarter due to mine sequencing. When compared to the same quarter last year, production decreased by 6%, primarily due to lower stacking volumes in Q2 2025, impacted by higher rainfall levels during the period and was in line with the Company's expectations.Net Revenue totaled US$55.8 million in Q2 2025, up 16% from Q1 2025, due to higher gold prices and sales volumes, while in comparison to Q2 2024 it grew 33%, mainly due to the increase in the price of gold over the period. In H1 2025, Net Revenue reached US$103.8 million, 30% higher than H1 2024.The Cash Cost was US$1,178/GEO in Q2 2025, 3% higher than Q1 2025 and 8% higher than Q2 2024, due to lower production as result of the lower stacking volumes. In H1 2025, Cash Cost was US$1,164/GEO, 2% increase compared to H1 2024, due to lower grades and slightly higher mine costs. Considering these effects, All-In Sustaining Cost totaled US$1,292/GEO for the quarter, an increase of 3% compared to Q1 2025 and 12% compared to Q2 2024.The Adjusted EBITDA totaled US$33.5 million in Q2 2025, up 84% versus Q2 2024, reflecting the positive impact of a strong cost control and higher gold prices, while it was up 25% versus Q1 2025. In H1 2025, Adjusted EBITDA reached US$60.4 million, an increase of 84%. Minosa's Net Income totaled US$23.7 million for the quarter, up 125% in Q2 2024 and 36% in Q1 2025, resulting in a Net income of US$ 41.1 million in the H1 2025.3.4 Almas (US$ thousand)Q2 2025 Q1 2025 % Q2 2024 % H1 2025 H1 2024 Full story available on Benzinga.com