When is the Sephora fall sale in Canada? What we know so far

Sephora has announced details ahead of its 2025 fall Savings Event

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Sephora has announced details ahead of its 2025 fall Savings Event

Wall Street advanced on Monday as investor concerns over the stability of regional banks eased, turning focus to a wave of corporate earnings and a closely watched inflation report. Earnings season shifts into high gear this week, with Wall Street heavyweights, including Tesla, Ford, GM, Netflix, Procter & Gamble, Coca-Cola, IBM and Intel, set to [...]The post Wall Street Climbs With Earnings, Inflation Set to Test Sentiment appeared first on GV Wire.

NEW YORK, Oct. 20, 2025 (GLOBE NEWSWIRE) -- Bishop Street Underwriters (“Bishop Street”), a RedBird Capital Partners portfolio company, today announced the rollout of Bishop Street Program Managers (“BSPM”), an incubator for developing managing general agents (“MGA”). Embedded within the...

Conestoga Capital Advisors, an asset management company, released its third-quarter 2025 investor letter. A copy of the letter can be downloaded here. Equity markets continued their momentum that began in early April, reaching new all-time highs in the third quarter. The Conestoga Micro-Cap Composite returned 11.7% net-of-fees in the third quarter, compared to the Russell Microcap [...]

Eaton Corp (NYSE:ETN) has outperformed the market over the past 20 years by 4.75% on an annualized basis producing an average annual return of 13.81%. Currently, Eaton Corp has a market capitalization of $146.22 billion. Buying $1000 In ETN: If ...Full story available on Benzinga.com

St. John's, Newfoundland--(Newsfile Corp. - October 20, 2025) - Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) ("Sokoman" or the "Company") further to its October 8, 2025 news release the Company is pleased to provide further details regarding the expansion of the Company's holdings along the Valentine Lake Fault.Sokoman has...

The annual membership cost to enter Costco's big-box warehouses and stock up on bulk groceries — not to mention the free food samples — has gone up. But that's not stopping fans from becoming or remaining loyal members.

Americans across the country are struggling with sky-high food prices.

After years of being a vacant eyesore, two half-built hotels in Muskegon County have been repurposed into a new apartment complex.

The global Pulse Ingredients Market is witnessing substantial growth driven by rising consumer preference for plant-based proteins, expanding vegan and vegetarian populations, and increasing applications in food and beverage formulations. However, fluctuating raw material prices and...

Dan Latinsky also joins leadership team as Chief Risk Officer Dan Latinsky also joins leadership team as Chief Risk Officer

On Monday, October 20, Claim $300 in bonus bets with the latest FanDuel promo code for NFL Week 7 Monday Night Football. Bet $5 on Lions vs. Bucs or Texans vs. Seahawks to unlock this nationwide offer.

Asian markets rose Monday after conciliatory comments from Donald Trump at the weekend ease worries about China-US trade tensions, while Tokyo stocks surged to a record on news of a deal to end political turmoil in Japan. Investors also took heart from data showing China’s economy grew more than expected in the third quarter, with [...]The post Asian markets bounce back as China-US trade fears ease appeared first on Digital Journal.

(MENAFN - GlobeNewsWire - Nasdaq) To the Nasdaq Copenhagen Debtor distribution data (CK92) Pursuant to s 24 Danish Capital Markets Act, Nykredit Realkredit A/S hereby publishes debtor distribution ...

Private Trust Co. NA lifted its stake in shares of Capital One Financial Corporation (NYSE:COF) by 90.4% in the 2nd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 3,073 shares of the financial services provider’s stock after acquiring an additional 1,459 shares [...]

Gladwyn Financial Advisors Inc. bought a new position in iShares Core U.S. Aggregate Bond ETF (NYSEARCA:AGG – Free Report) during the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor bought 10,773 shares of the company’s stock, valued at approximately $1,069,000. iShares Core U.S. [...]

Kelman Lazarov Inc. reduced its stake in Mastercard Incorporated (NYSE:MA – Free Report) by 1.0% in the 2nd quarter, according to the company in its most recent filing with the SEC. The fund owned 4,026 shares of the credit services provider’s stock after selling 40 shares during the quarter. Kelman Lazarov Inc.’s holdings in Mastercard [...]

Liberty Broadband preferreds offer a 7% yield, trade below par, and will convert to Charter with a 2039 mandatory redemption. See why LBRDP stock is a buy.

The DraftKings promo code for NFL Week 7 Sunday games unlocks access to a $300 bonus along with three months of League Pass.

(MENAFN - News Direct) >These days, most people are under the impression that the only way they can afford to retire is doing so as a millionaire. More specifically, many Canadians believe ...

(MENAFN - News Direct) >Free iPhone 17 just for opening a bank account? Sounds like a no-brainer, right?Canadian banks and fintechs continually roll out flashy promotions to lure in new customers ...

(MENAFN - News Direct) >Anyone who's spent time in Alberta knows the province marches to the beat of its own drum.Thinking about making the move to Wild Rose Country? You're in the right place. ...

(MENAFN - News Direct) >This article adheres to strict editorial standards. Some or all links may be monetized.Without a well-defined plan for spending in retirement, Americans could be facing ...

(MENAFN - News Direct) >Tariffs continue to shape the economic landscape - and for many Americans, they've meant higher prices on everyday goods. The Trump administration's renewed tariffs have ...

The center distributes China’s standard time and provides timing services to industries such as communications, finance, power, transport and defense.

TrueMark Investments LLC raised its position in UnitedHealth Group Incorporated (NYSE:UNH – Free Report) by 128.0% in the second quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 29,515 shares of the healthcare conglomerate’s stock after acquiring an additional 16,567 shares during the quarter. [...]

Burford Brothers Inc. boosted its holdings in shares of Altria Group, Inc. (NYSE:MO – Free Report) by 6.7% in the 2nd quarter, Holdings Channel.com reports. The institutional investor owned 39,154 shares of the company’s stock after buying an additional 2,468 shares during the period. Altria Group makes up approximately 1.1% of Burford Brothers Inc.’s investment [...]

Cidel Asset Management Inc. decreased its stake in shares of Philip Morris International Inc. (NYSE:PM – Free Report) by 10.8% during the second quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 8,660 shares of the company’s stock after selling 1,050 shares during [...]

Sigma Investment Counselors Inc. boosted its stake in shares of Schwab US Dividend Equity ETF (NYSEARCA:SCHD – Free Report) by 8.0% during the second quarter, according to its most recent Form 13F filing with the SEC. The fund owned 22,243 shares of the company’s stock after buying an additional 1,648 shares during the period. Sigma [...]

VIRGINIA RETIREMENT SYSTEMS ET Al acquired a new position in UnitedHealth Group Incorporated (NYSE:UNH – Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The fund acquired 126,600 shares of the healthcare conglomerate’s stock, valued at approximately $39,495,000. Several other institutional investors have also recently [...]

Chicago Partners Investment Group LLC raised its stake in shares of Vanguard Mid-Cap ETF (NYSEARCA:VO – Free Report) by 1.5% during the 2nd quarter, HoldingsChannel.com reports. The firm owned 360,503 shares of the company’s stock after acquiring an additional 5,268 shares during the quarter. Vanguard Mid-Cap ETF makes up 3.0% of Chicago Partners Investment Group [...]

Catalyst Capital Advisors LLC trimmed its position in iShares Core S&P Mid-Cap ETF (NYSEARCA:IJH – Free Report) by 6.1% in the second quarter, according to its most recent filing with the SEC. The institutional investor owned 8,386,471 shares of the company’s stock after selling 545,540 shares during the period. iShares Core S&P Mid-Cap ETF comprises [...]

Goldstein Advisors LLC reduced its stake in RTX Corporation (NYSE:RTX – Free Report) by 67.9% during the second quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 2,312 shares of the company’s stock after selling 4,885 shares during the period. Goldstein Advisors LLC’s holdings in [...]

These Are The Cars With The Best Resale Value In 2025 Cars are one of the most significant purchases people make, but unlike real estate, their value drops quickly.To help you protect your investment, Visual Capitalist's Marcus Lu created this ranking highlighting the 13 cars with the best resale value in America, as of 2025.This means that all of the models shown in this graphic are from the 2022 model year.The data in this graphic was compiled by U.S. News, which analyzed pricing and resale trends across 2022 model-year vehicles. It measures the average value these cars lost from MSRP after three years, both as a percentage and in dollar terms.Toyota is #1 in Value RetentionToyota’s reputation for reliability and affordability continues to pay off in resale value.The Corolla Cross leads the list, depreciating just 2.63% (-$662) after three years. Other Toyota models such as the 4Runner, C-HR, and Tacoma also perform exceptionally well in this regard.Earlier this year, Toyota was ranked the fourth most reliable car brand in America, explaining its consistent demand in both the new and used markets.Japanese Cars Generally Depreciate SlowerBeyond Toyota, other Japanese brands also fare well. Subaru’s Crosstrek comes in fourth with a depreciation rate of just 4.90%, perhaps due to its all-wheel-drive versatility.Compact cars like the Honda Civic and Nissan Versa also appear in the top 10, offering a compelling mix of efficiency, practicality, and reliability.The Mustang EnduresAmong a sea of Japanese cars, the Ford Mustang stands out as the only American vehicle in this ranking.With an average depreciation of 5.41%, the Mustang’s enduring design and heritage help it resist the sharp value declines typical of many U.S. models.Another factor could be that the Mustang is the only gasoline-powered pony car still on sale today, with the Chevrolet Camaro and Dodge Challenger both recently ending production.If you enjoyed today’s post, check out The Best Used EVs in 2025 on Voronoi, the new app from Visual Capitalist. Tyler DurdenSat, 10/18/2025 - 22:45

The recall spans across three labels: El Mas Fino, Los Cabos and Midamar.

MT Billings MT Zone Forecast for Saturday, October 18, 2025

Traders described a growing panic as liquidity dried up. The cost of borrowing silver overnight soared to annualised rates of as high as 200%, according to consultancy Metals Focus

WY Billings MT Zone Forecast for Saturday, October 18, 2025

Do the Browns have any regrets about trading Joe Flacco? Or being left with such a high level of frustration?

CONYERS — At its Wednesday, Oct. 15 regular meeting, the Conyers City Council unanimously approved a license application for a new local microbrewery.

By David Shepardson WASHINGTON, Oct 18 (Reuters) – Democrats in Congress on Saturday criticized the Trump administration’s decision to buy two Gulfstream G700 jets for $172 million during the ongoing government shutdown...

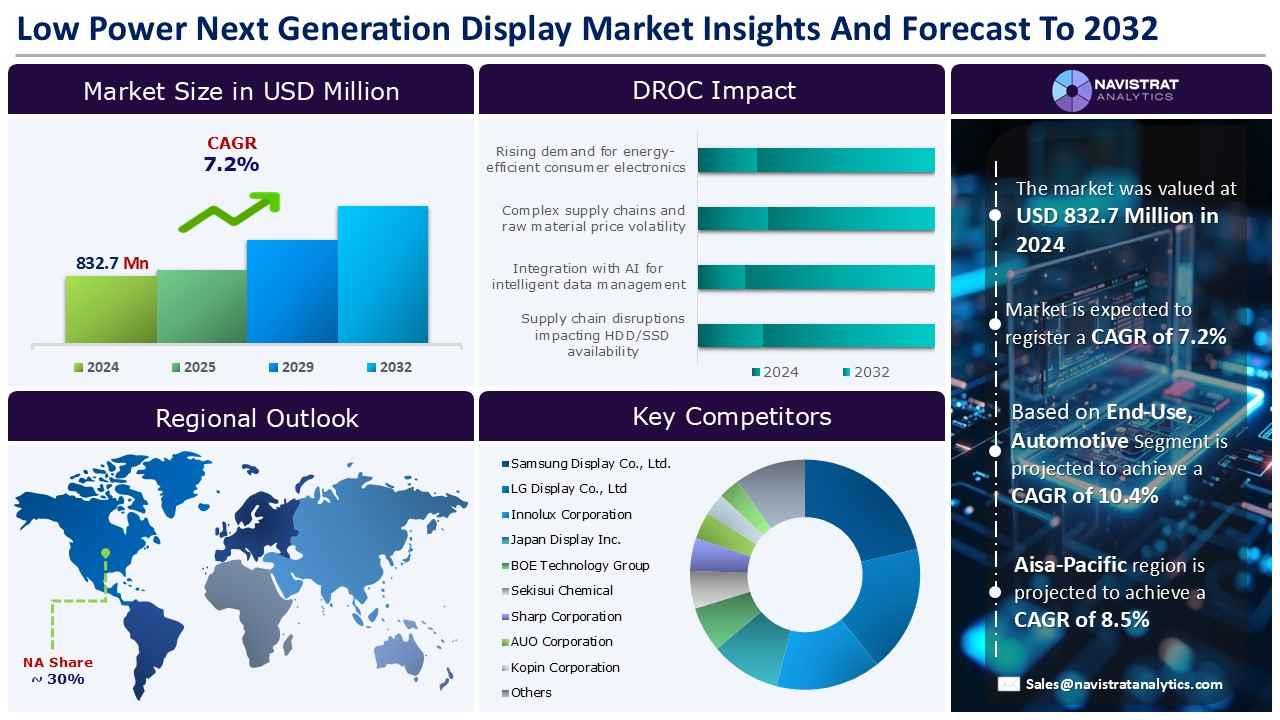

(MENAFN - Navistrat Analytics) The market's revenue growth is supported by the increased usage of wearable technologies and IoT as a result of 5G penetration. According to the GSMA, 5G networks are ...

Call it the China power paradox: while Beijing leads the world in renewable energy expansion, its coal projects are booming too.

The Gold And Silver Boom Is Ominous Authored by Jeffrey Tucker via The Epoch Times,We’ve not seen days like these for gold and silver since the late 1970s. It is nothing short of spectacular for investors and hoarders of the tried and true metals. People who have kept the faith in the real are being rewarded. For everyone else, these are scary signs concerning what might be coming our way.For thousands of years, these two metals have been the most valued in human experience. That’s why they became money, which is the good we acquire to buy other goods. Money becomes that because the market selects the good in question. It’s the most marketable commodity.Gold and silver have always fit the description because they have uniform quality, have a high value per unit of weight, they are durable, and are highly divisible. So they became money in most places in the industrializing world.I recently bought some old U.S. quarters and dimes, which were made of silver. The price is far above the stated value because the money was devalued, while the specie value kept rising. They are really wonderful to hold and own because they serve as a reminder of what sound money means. They also symbolize economic and financial independence.It’s been half a century since the age of fiat money dawned. The United States has tried an experiment to make due with a currency that has no underlying integrity. It’s just paper or just digits. This was supposed to be more modern. We turned our backs on the “barbarous relic,” as J.M. Keynes called gold.The prediction made early in the fiat age was that these metals would fall in value to reflect their industrial uses. The monetary premium would disappear because they would no longer be money. The intellectuals, not the relics, would be in charge now.The very opposite happened. Throughout the 1970s, both gold and silver boomed. It was a massive vote of confidence in the real and an insult to the new elites who promised a better system. It humiliated them.We seemed to have embarked on another wave of the same. They are both soaring.Source: BloombergFor all the world, this feels like a flight to the real. Central banks want gold and silver. Large investors. Heavily leveraged brokers. Huge institutions. Regular consumers. Everyone is grabbing as much of the stuff as possible right now.Will there be a correction? Maybe. But this is truly worrisome. It reveals a lack of confidence in our fiat world.The data right now seems to back up a genuine cause for worry. Inflation nearly disappeared completely once Trump took office. It happened without explanation. Maybe it was a reflection of optimism by business that they could eat more of the increased wholesale costs because big profits were headed their way.While dramatic things are happening under Trump in many areas—immigration, trade, cuts in the power and reach of the civil service, the end of DEI, new liberties in speech, truth in public health—other realms have not been so great. Spending is out of control, still. The Fed has accelerated quantitative easing yet again. And the Trump administration is pushing for lower interest rates.Meanwhile, inflation is no longer declining. It is increasing.This is not a good trend. It is ominous for the Trump administration.If there is one force in the world capable of wiping out all the good that has happened since January 2025, it is inflation. If people cannot pay their bills, all of politics becomes theater. People will blame Trump, rightly or wrongly. This will be on his watch.There is this long history of governments being unaware of the inflation problem until it is too late. The Weimar central bank of 1920 had no idea that the complete destruction of the German currency was three years into the future. This is because central bankers always and everywhere are convinced that they have matters under control.They do have things under control until they do not. This is the worry. The Fed right now needs to defy the Trump administration and keep rates high and money tight. They could in fact prompt a recession but this can be mitigated with deregulation and a lower tax burden.What is not easily fixed is a second wave of inflation. This is precisely what the increase in precious metals prices portends. It is sending a grave signal that markets are unconvinced that the Trump administration has the fiscal and monetary situation under control. Truth is that it does not. The debt problem is getting worse, not better. The red ink seems to flow regardless of whatever DOGE has done and regardless of all the cuts in bureaucracy and agency costs.Here is the root cause of the gold and silver boom. It represents a flight to safety in anticipation of some possible crisis in the future. But there are other matters too, such as an emerging regional bank crisis. There are lingering issues concerning commercial real estate yet resolved. No one knows for sure how firm or shaky the fiat financial system truly is.A serious financial crisis could in fact be around the corner. Housing is out of control. Financial markets have gone absolutely bonkers over AI. The leverage in every sector is without precedent. It’s all rooted in a belief that a fiat world is practicable and possible. But is it really? Many people are starting to doubt it.When you hold physical gold and silver, you feel it and know it. It is the real deal. No permissions. No governments. No authorities. No brokers. It’s secure value and nothing more. It represents independence and freedom.Remember that we live in a time when trust is lost in nearly everything. It makes sense that this would extend to financial intermediaries too. No one is putting 100 percent of their net wealth into precious metals. Investing is all about hedging risk in many directions, involving many scenarios.Apparently one of those scenarios that is being entertained among people with big money is the possibility of complete financial and monetary breakdown. The Trump administration needs to pay close attention to this and the signal it is sending. There are ways to fix this problem but it is going to require some very hard decisions.The markets never tell the perfect truth but they are sending a message that deserves close attention. Gold and silver were supposed to be gone by now but here we are. They are back again and with ferocity. Tyler DurdenSat, 10/18/2025 - 22:10

Call it the China power paradox: while Beijing leads the world in renewable energy expansion, its coal projects are booming too. As the top emitter of greenhouse gases, China will largely determine whether the world avoids the worst effects of climate change. On the one hand, the picture looks positive. Gleaming solar farms now sprawl [...]The post China’s power paradox: record renewables, continued coal appeared first on Digital Journal.

Koshinski Asset Management Inc. reduced its holdings in iShares Core S&P Small-Cap ETF (NYSEARCA:IJR – Free Report) by 4.6% during the second quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The fund owned 29,029 shares of the exchange traded fund’s stock after selling 1,400 shares during the quarter. Koshinski [...]

Citizens Business Bank cut its holdings in shares of QUALCOMM Incorporated (NASDAQ:QCOM – Free Report) by 3.0% during the 2nd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 16,717 shares of the wireless technology company’s stock after selling 509 shares during the quarter. Citizens Business Bank’s holdings [...]

Citizens Business Bank lessened its stake in shares of iShares MSCI EAFE ETF (NYSEARCA:EFA – Free Report) by 1.7% in the 2nd quarter, Holdings Channel.com reports. The institutional investor owned 102,393 shares of the exchange traded fund’s stock after selling 1,821 shares during the period. iShares MSCI EAFE ETF accounts for 1.8% of Citizens Business [...]

Private Wealth Management Group LLC boosted its position in shares of Vanguard S&P 500 ETF (NYSEARCA:VOO – Free Report) by 3.7% in the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 562 shares of the company’s stock after buying an additional 20 shares during the quarter. [...]

Koshinski Asset Management Inc. lifted its holdings in Netflix, Inc. (NASDAQ:NFLX – Free Report) by 18.0% in the second quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,290 shares of the Internet television network’s stock after acquiring an additional 350 shares during the period. [...]

Hamlin Capital Management LLC increased its position in shares of Texas Instruments Incorporated (NASDAQ:TXN – Free Report) by 14.2% in the 2nd quarter, Holdings Channel.com reports. The firm owned 1,030,894 shares of the semiconductor company’s stock after acquiring an additional 128,408 shares during the quarter. Texas Instruments makes up 5.0% of Hamlin Capital Management LLC’s [...]

Koshinski Asset Management Inc. lifted its position in shares of Texas Instruments Incorporated (NASDAQ:TXN – Free Report) by 5.6% during the second quarter, Holdings Channel reports. The firm owned 18,455 shares of the semiconductor company’s stock after acquiring an additional 982 shares during the period. Koshinski Asset Management Inc.’s holdings in Texas Instruments were worth [...]

Manchester Financial Inc. increased its position in Vanguard S&P 500 ETF (NYSEARCA:VOO – Free Report) by 20.7% in the 2nd quarter, HoldingsChannel.com reports. The institutional investor owned 817 shares of the company’s stock after acquiring an additional 140 shares during the quarter. Manchester Financial Inc.’s holdings in Vanguard S&P 500 ETF were worth $464,000 at [...]

Personal finance contributor Christopher Liew offers practical strategies for parents who want to support their children's financial futures without compromising their own retirement savings or financial stability.

Helping your kids financially: 5 smart ways that won’t derail your retirement CTV News

A great but unheralded feature of the One Big Beautiful Bill passed in July was an authorization for the Federal Communications Commission to raise $88 billion to $100 billion through electronic spectrum auctions.

Mandala Chain on Ethereum, featuring Mandala AI, is driving the crypto presale market with innovative blockchain solutions and investment opportunities.

Ottawa commits $82.3M to Manitoba infrastructure projects, funding roads, transit, and community upgrades across 137 municipalities. Read more.

(MENAFN - GlobeNewsWire - Nasdaq) Explore trusted casinos offering a brand new online casinos USA no deposit bonus and USA no deposit bonus deals in 2025. New York City, NY, Oct. 18, 2025 (GLOBE ...

The White House asked university leaders to provide initial feedback on the compact by Oct. 20, yet as the deadline approaches, none has signed on to the document.

Goldman Sachs trader Mike Washington dismisses AI stock bubble fears, citing tangible revenues, economic integration, and disciplined investments unlike the dot-com era. While CEO David Solomon warns of inevitable drawdowns and critics highlight overvaluation, Goldman projects trillions in value, viewing AI as a sustainable paradigm shift.

The bet365 bonus code WEEK365 will unlock access to a $200 bonus for college football Week 8 matchups and more.

Betr promo code NEWSWEEK will score a $210 bonus for picks across NFL Week 7 action and more this weekend.

Emerson Electric Co. (NYSE:EMR) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. Emerson Electric Co. (NYSE:EMR) is an American manufacturing company that provides a wide range of products and services for commercial, industrial, and consumer markets. On October 15, JPMorgan raised its price target for Emerson Electric Co. (NYSE:EMR) [...]

FRANKFORT – Gov. Andy Beshear’s economic development trip to Europe already is bearing fruit, as a manufacturer has committed to bringing a new facility to Barren County, creating hundreds of new jobs.

Lowe’s Companies, Inc. (NYSE:LOW) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. Lowe’s Companies, Inc. (NYSE:LOW) is an American retailer focused on home improvement products and services. On October 9, the company announced the completion of its acquisition of Foundation Building Materials (FBM), a leading distributor of construction materials [...]

Chubb Limited (NYSE:CB) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. On October 14, Citizens has reaffirmed its Market Outperform rating on Chubb Limited (NYSE:CB) and set a price target of $325. The firm maintained its optimistic view of the insurer, pointing to Chubb’s strong earnings per share growth [...]

ATLANTA, Oct. 17, 2025 /PRNewswire/ -- Sucheta Kamath, CEO & Founder, ExQ, launches the Executive Function Advocacy Toolkit to raise awareness for the value and impact of teaching Executive Function skills, the cognitive and affective skills essential for students to be prepared for...

Dover Corporation (NYSE:DOV) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. On October 15, JPMorgan raised its price target for Dover Corporation (NYSE:DOV) from $217 to $220 while maintaining an Overweight rating on the stock. The update came as part of its Q3 earnings preview for the electrical equipment [...]

VANCOUVER, British Columbia, Oct. 17, 2025 (GLOBE NEWSWIRE) — Westhaven Gold Corp. (TSX-V:WHN) announces the departure of VP Corporate Development & Investor Relations Sean Thompson from the Company. Gareth Thomas, Director of Westhaven stated “On behalf of the Board of Directors of Westhaven, I’d like to thank Sean for his important contributions to the Company [...]

Victor Hanson: How Biden & Obama Failed In The Middle East Authored by Victor Davis Hanson,The short answer to why both the Biden and Obama administrations failed to achieve peace in the Middle East is that they took actions opposite to Trump’s current efforts, which have led to a ceasefire.First, consider Iran.Iran was flush with cash, on a trajectory toward a nuclear weapon, and arming Israel’s “ring of fire” enemies: Hamas, Hezbollah, and the Houthis.The radical Islamic world of the Middle East was convinced that Israel would be doomed eventually.Yet both Democratic administrations let Iran profit from oil sales.They talked of delaying, but not ending, Iran’s nuclear program. And they feared that Hezbollah, Hamas, and the Houthis were indomitable terrorist threats.Thus, the disruptors of peace were appeased rather than deterred.Two, both Obama and Biden pressured Israel in general and Netanyahu in particular to make constant concessions.But neither offered any plan for how Israel was to survive when Iran sought its destruction, and Tehran’s terrorist triad aimed to bombard it with missiles, rockets, and drones.Worse, once the larger Middle East saw Democratic presidents appeasing Iran and its terrorist appendages, they concluded it was unsafe to take risks by allying with a delusional United States.Three, both Obama and Biden despised and personally insulted Benjamin Netanyahu, Egyptian President Abdel Fattah el-Sisi, and the Saudi royal family.Biden called Saudi Arabia a “pariah state”—at least until he needed it to pump more oil to lower gas prices before the 2022 midterms.Both presidents sought to isolate Sisi and remove him from power.Obama had his team leak insults to Netanyahu, most infamously the “chicken sh—t” smear.Middle Easterners have long memories.Obama never would have thought up the Abraham Accords. Biden foolishly derailed and then pathetically tried to resurrect them.Neither the Gulf monarchies, Egypt, nor any conservative government in Israel had any incentive to deal with Obama and Biden, whom they despised.Yet the more Trump respected and engaged with the Gulf sheikhs, Sisi, and Netanyahu, the more their collective fortunes—and his influence over their nations—increased.Four, the Obama and Biden administrations were reluctant to use force to curb terrorism in the Middle East.Neither would ever have taken out Iranian general Qassem Soleimani and the ISIS founder Abu Bakr al-Baghdadi, destroyed ISIS, obliterated much of Russia’s Wagner group, or hit the Houthis hard.The result was that neither the Israelis nor the Arabs trusted Obama and Biden. So they were careful not to take risks, fearing the U.S. would leave them hanging.Five, on the global stage, both Democratic administrations had radiated a general sense of appeasement and indecision that empowered enemies and scared off friends.The Middle East remembered the 2011 Libyan bombing misadventure and John Kerry’s pathetic 2013 courting of Russian help in the Middle East.It recalled the 2014 Russian takeover of Crimea and Donbass, the 2016 appeasement of Iran to cut a nuclear deal, and the 2021 Chinese dressing down of Biden diplomats in Anchorage.It was shocked by the 2021 humiliating skedaddle from Afghanistan, the 2022 Russian assault on Kyiv, and the 2023 Chinese balloon fiasco.The Middle East concluded that America was in managed decline. It could not or would not defend its own interests, much less those of its expendable friends.Six, Obama—and especially Biden—were constrained by their domestic bases in a way Trump was not.The pro-Hamas, anti-Israel left deterred Democratic presidents from taking risks. In contrast, Trump withstood MAGA fury about bombing Iran or allowing Netanyahu to destroy most of Hamas.Seven, the Democrats talked diplomatese. They looked down on mercantilism—and so never connected with either the Arabs or Israelis.Trump equated a peace deal with prosperity. He promised that almost all interests would profit mutually.For negotiations, he preferred businessmen—himself, Jared Kushner, and Steve Witkoff—to diplomats.It turned out that the Arabs and Israelis did as well.Eight, Obama and Biden were infamous for their empty threats. Few ever believed Obama’s 2012 “redlines” issued to Syria on WMD.No one took seriously Biden’s 2022 threat of “don’t” when Russia was on the verge of invading Ukraine.In contrast, Trump’s threats were all too real.Nine, past American administrations were frustrated with a duplicitous Qatar. And so they appeased it. Trump offered both carrots and sticks. After Israel bombed Qatar, the regime sought Trump’s support, shaken and ready to help.Ten, the Obama and Biden teams—Hillary Clinton, John Kerry, Susan Rice, Leon Panetta, Jake Sullivan, Antony Blinken, and Lloyd Austin—were force multipliers of their presidents’ naïveté and incompetence.By contrast, Sen. Marco Rubio, Gens. Erik Kurilla and Dan Caine, Steve Witkoff, and Jared Kushner shaped, shared, and empowered Trump’s agenda.* * *Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge. Tyler DurdenFri, 10/17/2025 - 22:35

Progress in business rarely comes from staying within the lines.The post Entrepreneurs driving innovation and transforming their fields appeared first on Digital Journal.

Gas prices are on a downward trend with some industry experts saying gas could go below $1.10 per litre in Manitoba—but there may be a short-term bump at the pump after a fire at an Indiana oil refinery.

Caterpillar Inc. (NYSE:CAT) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. BofA Securities raised its price target for Caterpillar Inc. (NYSE:CAT) from $517 to $594 on October 15 while keeping a Buy rating on the stock. The revision came after the firm’s review of the small turbine market, where [...]

"We do need to start to build something that would benefit the overall community on this very prestigious location,” said Kelowna mayor Tom Dyas.

COAL TOWNSHIP — Staffing and retention have been SCI-Coal Township’s biggest hurdles since the COVID-19 pandemic began five and a half years ago, but its staff and superintendent have leaned into outreach tactics to overcome them.

MOUNT CARMEL — The Mount Carmel Area School Board approved a new five-year contract for Superintendent Pete Cheddar, which includes a $5,000 salary bump for the 2025-26 school year, during its meeting Thursday.

Pentair plc (NYSE:PNR) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. Pentair plc (NYSE:PNR) is an American company known for its expertise in water treatment technologies. While it operates primarily from the United States, the company is incorporated in Ireland and holds its tax residency in the United Kingdom. [...]

Walmart Inc. (NYSE:WMT) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. On October 15, DA Davidson reaffirmed its Buy rating and $117.00 price target for Walmart Inc. (NYSE:WMT) after the retailer announced a partnership with OpenAI. The firm pointed out that Walmart’s new collaboration with OpenAI, revealed on Tuesday, [...]

Today, the 4th Annual Conservative Climate Summit was hosted at the University of Utah and Senator John Curtis spoke about clean energy goals in Utah.

Renewal Fuels (RNWF) on Friday said that it has achieved full compliance with all OTC Markets reporting requirements and has implemented significant governance and capital structure improvements, fueling gains in morning trading.

This year’s new mill rate is 23.85, which is about a 1 mill increase over last year’s rate.

What if your parents have no retirement savings? This is an issue that a Reddit user is currently dealing with. His parents are Baby Boomers who, he says, exhausted their funds five years ago — although they only told him when they were on the brink of homelessness. Because of health problems and age-related constraints ... My boomer parents ran out of money 5 years ago, but didn’t tell me they have nothing for retirement until the last minuteThe post My boomer parents ran out of money 5 years ago, but didn’t tell me they have nothing for retirement until the last minute appeared first on 24/7 Wall St..

Between the Trump administration’s ongoing trade war, the federal government shutdown and now regional banks disclosing issues with bad and fraudulent loans, markets are still attempting to shrug off the concerns. Some economists and financial analysts are also concerned that the AI bubble popping sooner than later. Others are not buying into that idea, though. ... Analysts Aren’t Buying into AI Bubble Fears — Instead, They’re Even More BullishThe post Analysts Aren’t Buying into AI Bubble Fears — Instead, They’re Even More Bullish appeared first on 24/7 Wall St..

If you’re nearing retirement or thinking about it, the last thing you want to do is run into financial setbacks. Unfortunately, many continue to make mistakes again and again. One of the top mistakes is claiming Social Security too early. Social Security is only designed to replace about 40% of your working income, according to ... Suze Orman’s Biggest Retirement Traps to Avoid In 2025The post Suze Orman’s Biggest Retirement Traps to Avoid In 2025 appeared first on 24/7 Wall St..

LOS ANGELES, Oct. 17, 2025 /PRNewswire/ -- IDrive e2, a leading provider of object storage, today announced the full integration of IDrive e2, its affordable and high-performance S3-compatible object storage platform, with MSP360, a leader in backup and IT management solutions. MSP360...

Nordea Investment Management AB lowered its stake in Wells Fargo & Company (NYSE:WFC) by 2.6% during the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 5,783,095 shares of the financial services provider’s stock after selling 156,079 shares during the quarter. Nordea Investment Management AB owned about [...]

Nordea Investment Management AB boosted its holdings in shares of The Home Depot, Inc. (NYSE:HD – Free Report) by 1.2% during the second quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 948,793 shares of the home improvement retailer’s stock after buying an additional [...]

Empirical Asset Management LLC acquired a new position in shares of Dell Technologies Inc. (NYSE:DELL – Free Report) during the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 5,573 shares of the technology company’s stock, valued at approximately $683,000. Several other [...]

Newsmax Inc. is a high-risk, speculative play best suited for active traders seeking short-term gains from volatility. Learn more about NMAX stock here.

Wall Street’s main indexes were mixed at open on Friday after U.S. President Donald Trump confirmed the meeting with his Chinese counterpart was still on, while worries over regional bank credit issues kept investors on edge. The Dow Jones Industrial Average fell 89.9 points, or 0.20%, at the open to 45,862.37. The S&P 500 fell [...]The post Wall Street Opens Mixed After Trump’s Trade Comments, Banks in Focus appeared first on GV Wire.

MAHLE earned recognition from Nissan North America based on its global sustainability performanceThe accolade highlights MAHLE's proactive efforts for climate protection in its product portfolio as well as in its plant operationsMAHLE was one of only two companies to receive...

Construction on a stretch of the Gardiner Expressway that was set to be completed by spring 2026 will now be done by the end of October.

American Battery Technology Co (NASDAQ:ABAT) stock is trading lower Friday morning, extending recent losses after the company announced the U.S. Department of Energy terminated a $115 million grant.ABAT stock is struggling to find support. Track the action here.What To Know: The funding was intended for the construction of a commercial-scale lithium hydroxide production facility in Nevada, a key project aimed at strengthening the domestic supply chain for electric vehicle batteries.The DOE's decision followed a review of federal clean-energy spending. In response, American Battery Technology has formally appealed the decision and stated its commitment to advancing the project. The company noted ...Full story available on Benzinga.com

During the quarter, Zee Entertainment's advertising revenue dropped 10.6 per cent to ₹806.3 crore, marking the sixth consecutive quarter of decline, against ₹901.7 crore a year ago.

NextEra Energy, Inc. (NYSE:NEE) is included among the 15 Dividend Stocks that Have Raised Payouts for 20+ Years. On October 6, Evercore ISI began coverage on NextEra Energy, Inc. (NYSE:NEE), assigning it an Outperform rating and setting a price target of $92. The firm pointed out that NextEra leads the country in wind and solar [...]

Farmers Bank announces Huseman new network administrator Farmers Trust and Savings Bank announced that John Huseman has joined the bank as its new IT network administrator. In this role, Huseman will be part of a team that is responsible for overseeing the bank’s information technology infrastructure, ensuring secure and efficient network operations and supporting the bank’s staff to continue their [...]The post Business Briefs first appeared on Enterprise Media.

China's economy likely grew at its slowest pace in a year last quarter, according to an AFP survey, dragged down by lacklustre demand and a crisis in the crucial property sector, compounded by a trade war with the United States.

Asadej Kongsiri, President of the Stock Exchange of Thailand, says they are currently working on reforms similar to those in Japan and South Korea to strengthen investor confidence and improve shareholder returns. However, he emphasizes that lasting gains hinge on listed companies creating genuine shareholder value.

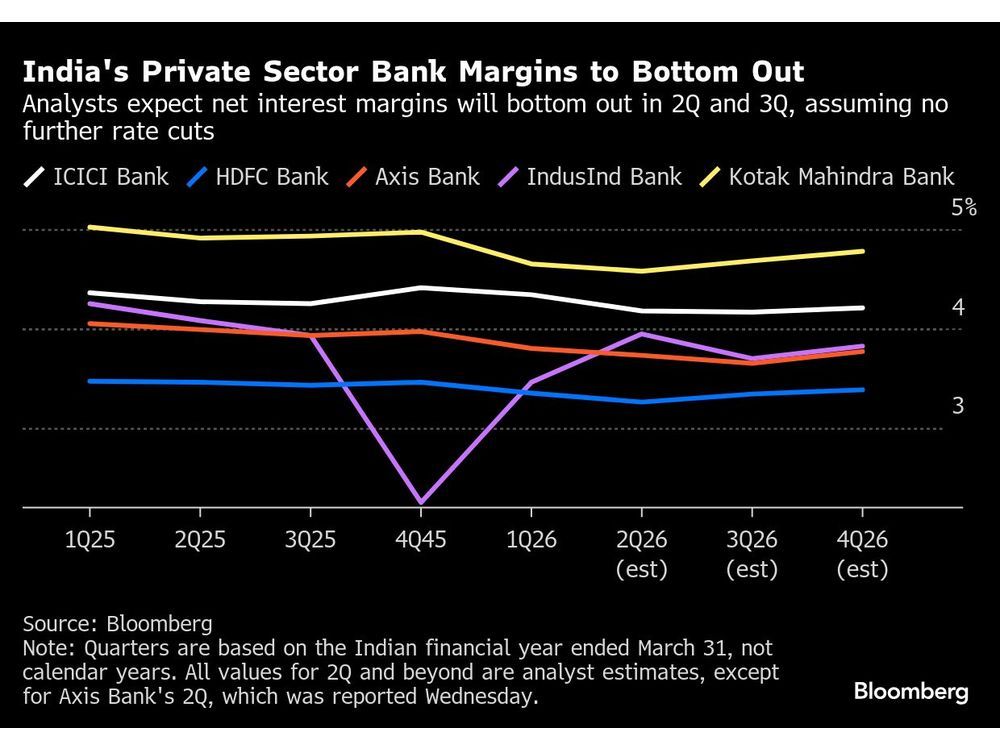

Indian banks including HDFC Bank Ltd. and ICICI Bank Ltd. earnings are expected to signal that margins have bottomed out, after the central bank’s recent rate-cutting cycle and tax breaks aimed at reviving economic growth.