Buy 928 Shares of This Stock for $300 in Monthly Dividend Income

Enbridge (TSX:ENB) has a 5.8% dividend yield.The post Buy 928 Shares of This Stock for $300 in Monthly Dividend Income appeared first on The Motley Fool Canada.

As an Amazon Associate I earn from qualifying purchases.

Know what the Bible says and understand why it matters with the fully revised NIV Study Bible featuring updated notes, full-color design, and Comfort Print typography designed for immersive reading.

A trusted companion for deep personal study, sermon prep, and devotional reading highlighted in our faith and leadership coverage.

Enbridge (TSX:ENB) has a 5.8% dividend yield.The post Buy 928 Shares of This Stock for $300 in Monthly Dividend Income appeared first on The Motley Fool Canada.

HUNTINGDON VALLEY, Pa., Dec. 5, 2025 /PRNewswire/ -- SRN Advisors, LLC (SRN) announced today that the Siren DIVCON Dividend Defender ETF (CBOE: DFND), an index-based exchange-traded fund ("ETF") managed by SRN, will reorganize into and with the Siren DIVCON Leaders...

Also: Proposed Midtown Business Improvement District moves forward, bill restricting residential building heights advances

Toronto, Ontario--(Newsfile Corp. - December 5, 2025) - Exploits Discovery Corp. (CSE: NFLD) (OTCQB: NFLDF) (FSE: 634) ("Exploits" or the "Company") is pleased to announce that it has closed the sale of a 100% interest in substantially all of its mineral claims (the "Claims") in central Newfoundland to New Found...

The Canadian Grain Commission (CGC) is not manually increasing its fees for grain inspection and weighing services until Apr. 1, 2028. Instead, any fee increase until then will be automatic and indexed to inflation.

With hundreds of exchange-traded funds (ETFs) available in the industry today, it can become overwhelming to pick the right one. ETFs cater to all investor needs; they fit any risk profile and have an investing time horizon that offers complete flexibility. ETFs have become an integral part of several portfolios, and Fidelity continues to play ... 2 Fidelity ETFs To Buy Before 2026The post 2 Fidelity ETFs To Buy Before 2026 appeared first on 24/7 Wall St..

The US is in talks to provide more than $1 billion for two critical minerals and railway projects in central Africa as it seeks to secure supplies deemed crucial for national security.

Trinity Capital Inc. stands out in the BDC space for its 14% dividend yield, niche growth strategy & rising book value. Read more on TRIN stock here.

Airlines were warned this week about the FAA's probe, which could result in heavy fines for companies that were not compliant.

The federal government is framing its new Climate Competitiveness Strategy as a jobs- and growth-focused approach to climate policy, pairing clean-economy investments with targeted support for sectors facing trade pressures, including agriculture.

Electricity prices have been on a roller coaster in the last few years, and at the moment they’re climbing — just in time for the start of winter.Nationally, residential electricity prices rose 10.5% between January and August of this year,...

Vancouver, British Columbia--(Newsfile Corp. - December 4, 2025) - Cosa Resources Corp. (TSXV: COSA) (OTCQB: COSAF) (FSE: SSKU) ("Cosa" or the "Company") is pleased to announce that it has closed the brokered private placement previously announced by the Company on November 13, 2025, as upsized on November 14, 2025, for...

Calgary, Alberta--(Newsfile Corp. - December 4, 2025) - Canamera Energy Metals Corp. (CSE: EMET) (the "Company") announces that it intends to complete a non-brokered private placement ("Private Placement") for gross proceeds of up to $1.12 million, by way of issue of up to 2,000,000 flow-through units ("FT Units") at a...

Shanghai, China--(Newsfile Corp. - December 4, 2025) - On December 2, 2025, Yunnan Province, as an emerging destination in China among Southeast Asia travellers, was invited to deliver a special presentation to highlight its rich cultural tourism resources, at the Trip.Best: Southeast Asia Travel Trends Unpacked Event at Resorts...

Markets were already expecting that the Fed would cut interest rates again at next week’s policy meeting ahead of yesterday’s of ADP’s estimate of private non-farm payrolls for November.

Comedy fans know him as a key part of the Blues Brothers band, but almost everyone knows his understated style from dozens of soul classics.

DFI Retail Group Holdings Limited (OTCPK:DFIHY) Analyst/Investor Day December 2, 2025 8:00 PM ESTCompany ParticipantsKaren ChanScott Price - Group CEO &...

Privia Health Group (NASDAQ:PRVA – Get Free Report)‘s stock had its “overweight” rating reissued by equities researchers at Stephens in a note issued to investors on Thursday,Benzinga reports. They currently have a $32.00 price target on the stock. Stephens’ price objective suggests a potential upside of 32.24% from the stock’s current price. PRVA has been [...]

Albemarle (NYSE:ALB – Get Free Report) had its price target upped by investment analysts at Rothschild & Co Redburn from $135.00 to $158.00 in a note issued to investors on Thursday,MarketScreener reports. The firm presently has a “buy” rating on the specialty chemicals company’s stock. Rothschild & Co Redburn’s target price would indicate a potential [...]

MongoDB (NASDAQ:MDB – Get Free Report) had its target price hoisted by investment analysts at Argus from $340.00 to $488.00 in a note issued to investors on Thursday,Benzinga reports. The firm currently has a “buy” rating on the stock. Argus’ price objective would indicate a potential upside of 20.21% from the stock’s previous close. Other [...]

BTIG Research upgraded shares of Dream Finders Homes (NYSE:DFH – Free Report) to a hold rating in a report issued on Monday morning,Zacks.com reports. Several other equities research analysts have also commented on DFH. Wall Street Zen upgraded Dream Finders Homes from a “sell” rating to a “hold” rating in a research note on Friday, [...]

Honeywell International (NASDAQ:HON – Get Free Report) had its price objective dropped by analysts at Barclays from $270.00 to $269.00 in a research note issued on Thursday,MarketScreener reports. The firm presently has an “overweight” rating on the conglomerate’s stock. Barclays‘s target price indicates a potential upside of 39.13% from the company’s current price. Other analysts [...]

The Descartes Systems Group (NASDAQ:DSGX – Get Free Report) (TSE:DSG) had its target price lowered by equities research analysts at BMO Capital Markets from $113.00 to $95.00 in a report issued on Thursday,Benzinga reports. The firm currently has a “market perform” rating on the technology company’s stock. BMO Capital Markets’ price target indicates a potential [...]

Baldwin Insurance Group (NASDAQ:BWIN – Get Free Report) had its price target lowered by analysts at BMO Capital Markets from $34.00 to $33.00 in a report released on Thursday,Benzinga reports. The firm presently has a “market perform” rating on the stock. BMO Capital Markets’ target price suggests a potential upside of 26.14% from the company’s [...]

NEW YORK (AP) — Stocks are holding near their records on Wall Street following mixed profit reports from companies, as Dollar General and Salesforce climb but Kroger falls. The S&P 500 rose 0.

TORONTO — Porter Airlines is taking off to Costa Rica with the start of roundtrip service between Toronto Pearson International Airport (YYZ) and Liberia, Costa Rica (LIR). This marks the airline’s first route to Central America. The Toronto-Liberia route operates up to six times weekly. It is the fourth in a series of new southern [...]

DUBAI, United Arab Emirates, Dec. 04, 2025 (GLOBE NEWSWIRE) -- Liminal Custody, a leading provider of digital asset custody tech and wallet infrastructure, announced the successful hosting of the second edition of its exclusive Global Access for Institutional Networks (G.A.I.N.) event at the Capital Club Dubai. The event, titled "Banking on Stablecoins: How to Build a Competitive Advantage," brought together regulators, banking leaders, and corporate finance executives to discuss the transformative role of stablecoins in the region's financial ecosystem.Building on the success of its inaugural edition, G.A.I.N. has established itself as a premier platform for fostering dialogue between traditional finance and the digital asset industry. The second edition highlighted new insights into how stablecoins are redefining cross-border payments, liquidity management, and treasury efficiency for institutions.Ilinca Cartoflea, Head of Sales, EMEA at Liminal Custody and co-host of the event, highlighted the rapid adoption of digital assets in the region:"Stablecoin payments in the region have grown by more than 80 percent year on year. With the recent approval of the first regulated multi chain AED backed stablecoin on public ...Full story available on Benzinga.com

Tesla stock could fall if Musk fails to get the company to reach these milestones.

Pulmonx Corporation (NASDAQ:LUNG – Get Free Report) General Counsel David Aaron Lehman sold 10,278 shares of Pulmonx stock in a transaction that occurred on Monday, December 1st. The stock was sold at an average price of $1.57, for a total transaction of $16,136.46. Following the completion of the sale, the general counsel owned 252,992 shares [...]

Meta is establishing a new creative studio in its Reality Labs division and has hired longtime Apple design executive Alan Dye to lead it. Mark Zuckerberg, CEO at Meta, announced these moves in a Wednesday (Dec. 3) post on Threads. The new studio will “define the next generation of our products and services” and [...]The post Meta Hires Apple Design Executive Alan Dye to Lead New Creative Studio appeared first on PYMNTS.com.

Tullow Oil plc (LON:TLW – Get Free Report)’s share price traded up 24.2% during mid-day trading on Monday . The company traded as high as GBX 6.10 and last traded at GBX 6. 26,866,404 shares changed hands during mid-day trading, an increase of 151% from the average session volume of 10,695,014 shares. The stock had [...]

VTR, WELL, and AHR offer strong growth from aging Baby Boomer demand. Current valuations underestimate the durability and longevity of the SH cycle. See more.

The Arizona Corporation Commission (ACC) voted 4-1 on Wednesday to approve a special Energy Supply Agreement between Tucson Electric Power and Delaware-based Humphrey’s Peak Power LLC.

A dozen former FDA commissioners condemn plan to tighten vaccine approvals The Washington PostFormer F.D.A. Commissioners Sound Alarm on Plan to Change Vaccine Policy The New York TimesFDA links 10 children's deaths to COVID-19 vaccines. Doctors want proof ABC NewsA dozen former FDA leaders lambaste claims by current FDA vaccine chief NBC NewsFDA official proposes ‘impossible’ standards for vaccine testing that could curtail access to immunizations CIDRAP

Semtech Corporation (SMTC) UBS Global Technology and AI Conference 2025 December 3, 2025 6:55 PM ESTCompany ParticipantsHong Hou - President, CEO &...

The Seattle-based startup that sells bitcoin and other cryptocurrencies through kiosks, has been ordered to refund $8.4 million and temporarily halt sales in Washington.

Opium poppy cultivation in Myanmar surged to its highest level in a decade this year as the nation engaged in a civil war remains one of the world’s primary suppliers of illicit drugs, according to a United Nations survey.

'As long as the CEO is happy with the $400-million gift he got from the prime minister, that's all that matters to these Liberals,' said Opposition Leader Pierre Poilievre

Poilievre attacks $400M ‘bailout’ of Algoma Steel with no job guarantees SooToday.comFord says he knew layoffs were coming before loaning Algoma Steel $100M Global News'It's all anxiety trying to figure out what the future will look like': Sault still processing 1,00O layoffs | CBC News CBCAlgoma Steel CEO: Feds knew about plans for layoffs before giving $400M loan CTV NewsVideo: Algoma Steel to lay off 1,000 workers, union says The Globe and Mail

The Denton City Council voted Tuesday night to approved a zoning change request from rural agricultural to planned development for the Craver Ranch special district, where a developer plans to build 9,000 homes.

Cameco (TSX:CCO) is a great top pick for a long-term TFSA that aims to compound wealth.The post 2 Top TFSA Stocks to Buy and Hold for the Long Term appeared first on The Motley Fool Canada.

Telus paused dividend hikes to prioritize cash flow and debt reduction, without cutting today’s hefty payout.The post What’s Going On With Telus’ Dividend? appeared first on The Motley Fool Canada.

SPOKANE, Wash. — Construction crews celebrated a major milestone Wednesday as they installed the tallest steel beam on the Spokane Falls Tower, marking the completion of the building's structural framework with a traditional topping ceremony.

SHENZHEN, China, Dec. 4, 2025 /PRNewswire/ -- On November 21, 2025, FASHION SOURCE and the SHENZHEN ORIGINAL FASHION WEEK concluded successfully at the Shenzhen Convention and Exhibition Center. The dual IP collaboration of "1 sourcing exhibition and 1 fashion week" invited 600...

TOKYO, JAPAN, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Linkage Global Inc (NASDAQ: LGCB) ("Linkage Global" or the "Company"), a cross-border e-commerce integrated services provider headquartered in Japan, today announced the closing of its previously announced private investment in public equity (the “PIPE”) financing. Pursuant to a securities purchase agreement dated November 24, 2025, the Company issued and sold an aggregate of 689,655 Class A Ordinary Shares at a purchase price of US$1.45 per share, resulting in gross proceeds of approximately US$1,000,000 before deducting fees and offering expenses payable by the Company. The net proceeds will be used for general corporate purposes, including working capital and the expansion of the Company’s cross‐border sales operations.

Click here to view this article from johnsoncitypress.com.

Market Analysis by covering: Gold Spot US Dollar, Silver Spot US Dollar. Read 's Market Analysis on Investing.com

Stocks are wavering on Wall Street following mixed profit reports from companies. The S&P 500 fell 0.1% in early trading Wednesday. The Dow Jones Industrial Average edged up 54 points, and the Nasdaq composite fell 0.4%. CrowdStrike sank despite topping...

With a few taps on their phones, parents can now see exactly when and where their child’s bus is along their route.

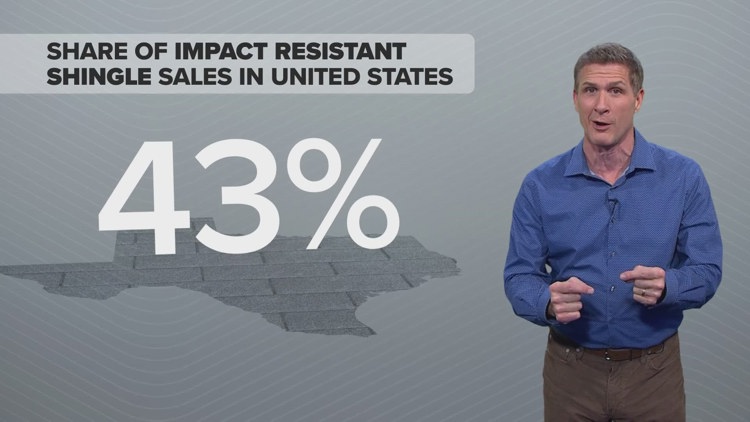

Texans are buying more impact-resistant shingles than anyone else.

CNBC's Andrew Ross Sorkin sits down with Treasury Secretary Scott Bessent to discuss tariffs, taxes and inflation at the New York Times' DealBook Summit.

Enbridge expects growth for 2026 as new projects enter service, raises dividend BNN BloombergView Full Coverage on Google News

COLLEGEDALE, Tenn., Dec. 3, 2025 /PRNewswire/ -- McKee Foods, the maker of Little Debbie® snacks, is proud to introduce its latest innovation: the Banana Puddin' Creme Pie, coming in January 2026. With this launch, Little Debbie combines nostalgic dessert comfort with modern convenience —...

Celestica, Inc. (NYSE:CLS – Get Free Report) (TSE:CLS) shares traded down 7.8% on Monday . The company traded as low as $316.73 and last traded at $317.6260. 3,117,543 shares were traded during trading, a decline of 22% from the average session volume of 3,971,785 shares. The stock had previously closed at $344.41. Analysts Set New [...]

Bath & Body Works, Inc. (NYSE:BBWI – Get Free Report) rose 6.7% during mid-day trading on Monday . The company traded as high as $18.45 and last traded at $18.5740. Approximately 2,018,681 shares were traded during trading, a decline of 66% from the average daily volume of 5,927,990 shares. The stock had previously closed at [...]

Caledonia Mining Corporation PLC (NYSEAMERICAN:CMCL – Get Free Report) traded down 9.9% on Monday . The stock traded as low as $28.42 and last traded at $27.77. 49,998 shares traded hands during mid-day trading, a decline of 70% from the average session volume of 169,327 shares. The stock had previously closed at $30.81. Caledonia Mining [...]

Scandium Canada Ltd. (CVE:SCD – Get Free Report) shares rose 28.6% during trading on Wednesday . The company traded as high as C$0.14 and last traded at C$0.14. Approximately 4,258,696 shares were traded during trading, an increase of 482% from the average daily volume of 731,660 shares. The stock had previously closed at C$0.11. Scandium [...]

Astera Labs, Inc. (NASDAQ:ALAB – Get Free Report)’s stock price was up 4.7% during mid-day trading on Monday . The stock traded as high as $162.49 and last traded at $165.0320. Approximately 1,031,286 shares were traded during trading, a decline of 81% from the average daily volume of 5,292,533 shares. The stock had previously closed [...]

Using a home equity loan or HELOC to buy a car puts your house on the line for a depreciating asset. Here's when—if ever—that trade-off makes sense.

Perrigo Company plc (NYSE:PRGO – Get Free Report)’s stock price traded up 3.9% during trading on Monday . The stock traded as high as $13.79 and last traded at $13.8730. 294,299 shares were traded during mid-day trading, a decline of 84% from the average session volume of 1,805,110 shares. The stock had previously closed at [...]

Shares of Wilmar International Ltd. (OTCMKTS:WLMIY – Get Free Report) traded up 5% during trading on Monday . The company traded as high as $26.07 and last traded at $26.07. 112 shares changed hands during mid-day trading, a decline of 100% from the average session volume of 48,734 shares. The stock had previously closed at [...]

First National Bank Alaska (OTCMKTS:FBAK – Get Free Report) traded down 7.1% during trading on Monday . The stock traded as low as $286.00 and last traded at $286.00. 45 shares changed hands during trading, a decline of 88% from the average session volume of 369 shares. The stock had previously closed at $307.74. First [...]

New Found Gold Corp. (NYSE:NFGC – Get Free Report) shot up 12.9% during mid-day trading on Monday . The stock traded as high as $2.63 and last traded at $2.7220. 486,700 shares were traded during mid-day trading, a decline of 56% from the average session volume of 1,111,088 shares. The stock had previously closed at [...]

Asian stocks traded within tight ranges early Wednesday, mirroring similar moves on Wall Street as investors treaded cautiously ahead of a slew of US economic data.

Nevada Gov. Joe Lombardo has signed his signature crime legislation, his office announced Tuesday

(MENAFN - GlobeNewsWire - Nasdaq) Pharma Equity Group A/S' agreement with Danske Bank as liquidity provider will terminate on 1 January 2026 3 December 2025 Company Announcement no. 14 Pharma ...

The Department of Audit and Control announced Tuesday that the City of Buffalo's budget deficit now totals $54.2 million.

2025-12-02. The following slide deck was published by Box, Inc.

(MENAFN) Democratic U.S. Senator Ron Wyden stated Tuesday that a bill he submitted to the Treasury Department, requesting it to provide records to Senate investigators concerning the late disgraced ...

MANKATO – With taxes going up across the county, Mankato Area Public School Board members acknowledged the difficult position they’re in.

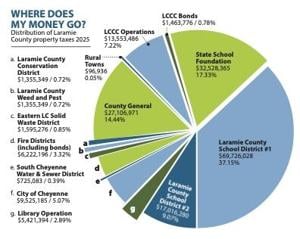

CHEYENNE – As state legislators discuss whether to eliminate residential property taxes for Wyoming residents, Laramie County and city officials say the changes, which would drain almost $62 million in tax revenue per year from the county, would be detrimental...

HANNIBAL — With the impending increase in revenue from the voter-approved public safety sales tax, the Hannibal City Council on Tuesday took steps to make improvements for the Hannibal Police Department.

BENTONVILLE -- Denser residential developments will be allowed on property in the downtown area.

First Republic Bank (OTCMKTS:FRCB – Get Free Report) and Bank of Hawaii (NYSE:BOH – Get Free Report) are both finance companies, but which is the superior business? We will compare the two businesses based on the strength of their profitability, institutional ownership, earnings, analyst recommendations, risk, dividends and valuation. Earnings & Valuation This table compares [...]

Molson Coors Beverage (NYSE:TAP – Get Free Report) and Crimson Wine Group (OTCMKTS:CWGL – Get Free Report) are both consumer staples companies, but which is the better investment? We will contrast the two businesses based on the strength of their institutional ownership, risk, dividends, profitability, analyst recommendations, earnings and valuation. Profitability This table compares Molson [...]

Fairfax India (OTCMKTS:FFXDF – Get Free Report) and Royalty Management (NASDAQ:RMCO – Get Free Report) are both finance companies, but which is the superior business? We will compare the two companies based on the strength of their earnings, institutional ownership, profitability, valuation, analyst recommendations, risk and dividends. Valuation & Earnings This table compares Fairfax India [...]

Life Time Group (NYSE:LTH – Get Free Report) and Target Hospitality (NASDAQ:TH – Get Free Report) are both consumer discretionary companies, but which is the better stock? We will contrast the two businesses based on the strength of their profitability, dividends, earnings, valuation, risk, analyst recommendations and institutional ownership. Valuation & Earnings This table compares [...]

YY Group (NASDAQ:YYGH – Get Free Report) and Cintas (NASDAQ:CTAS – Get Free Report) are both business services companies, but which is the superior stock? We will compare the two businesses based on the strength of their analyst recommendations, institutional ownership, dividends, profitability, valuation, risk and earnings. Risk & Volatility YY Group has a beta [...]

Cintas (NASDAQ:CTAS – Get Free Report) and YY Group (NASDAQ:YYGH – Get Free Report) are both business services companies, but which is the superior investment? We will contrast the two businesses based on the strength of their analyst recommendations, institutional ownership, profitability, valuation, dividends, earnings and risk. Profitability This table compares Cintas and YY Group’s [...]

Crimson Wine Group (OTCMKTS:CWGL – Get Free Report) and Molson Coors Beverage (NYSE:TAP – Get Free Report) are both consumer staples companies, but which is the better investment? We will compare the two businesses based on the strength of their risk, analyst recommendations, dividends, institutional ownership, earnings, valuation and profitability. Institutional and Insider Ownership 17.0% [...]

Market Analysis by covering: Gold Futures, Palladium Futures, Platinum Futures, Sibanye Gold Ltd ADR. Read 's Market Analysis on Investing.com CA.

TORONTO, Dec. 02, 2025 (GLOBE NEWSWIRE) — Purpose Investments Inc. (“Purpose”) today announced the estimated annual distributions of income and capital gains for its open-end exchange-traded funds and closed-end funds (the “Funds”) for the 2025 tax year. The estimated distributions represent estimated income earned and capital gains realized by the Funds during the year. Please [...]

You can still grab up to $1,000 off iPhones, Galaxy phones, Pixels and more. Act fast, these deals won’t last.

The USDINR is trading to new record highs. The rupee continues to face pressure from weak trade and investment flows, even as India remains the fastest-growing major economy and local equities hit record highs. Slowing goods exports and the drag from high tariffs pose additional risks to India’s growth, current account, and balance of payments, with some analysts expecting USDINR to weaken further unless tariffs are reduced. The rupee also hit a record low against the offshore yuan, reflecting broader regional currency softness despite a steady dollar index.Technically, tools can be applied that define risk for the buyers and also target levels. Knowing the risk and the targets provide traders with a roadmap, with defined risk, for trades. In the video, I talk about the risks for the buyers and the targets and create the roadmap for their trading in the USDINR. This article was written by Greg Michalowski at investinglive.com.

Clorox is a market leader in consumer products with a 48-year dividend growth streak and a nearly 5% yield, now trading at a decade-high yield. Learn more about CLX stock here.

We sighed a collective sigh of relief when the Belgian government finally reached the budget agreement last week. The negotiations had been really difficu

The OECD said the United States is outperforming other advanced economies largely because of exceptionally strong investment in ICT and AI.

TORONTO - Vale Base Metals says it has signed a deal with Glencore Canada to jointly evaluate a potential brownfield copper project at their adjacent properties in the Sudbury Basin

New investment boosts handling capacity to 2.1 million TEUs and builds on more than R$3 billion invested since 2013 SANTOS, Brazil, Dec. 02, 2025 (GLOBE NEWSWIRE) — DP World has approved a new R$1.6 billion (US$296 million) investment cycle to further strengthen Brazil’s trade capacity and enhance terminal operations at the Port of Santos, increasing [...]

GOOD MORNING...HERE IS YOUR MORNING MARKET NEWS OVERNIGHT GRAIN TRADE ICE canola futures are trading less than $1/tonne higher to start this morning...recovering slightly from Monday s decline, but off the overnight highs. Chicago soybean futures are moving 1 to 5 cents/bu higher this morning, led by the front month contracts. Oilseed market bulls seem [...] Read more

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades and downgrades, please see our analyst ratings page.Guggenheim raised Mongodb Inc (NASDAQ:MDB) price target from $400 to $450. Guggenheim analyst Howard Ma maintained a Buy rating. Mongodb shares closed at $328.87 on Monday. See how other analysts view this stock.B of A Securities raised the price target for XPO Inc (NYSE:XPO) from $151 to $158. B of A Securities analyst Ken Hoexter maintained a Buy rating. XPO shares closed at $143.43 on Monday. See how other analysts view this stock.JP Morgan raised Formula One Group (NASDAQ:FWONK) price target from $120 to $122. JP Morgan analyst David Karnovsky maintained an Overweight rating. Formula One Group shares closed at $94.80 on Monday. See how other analysts view ...Full story available on Benzinga.com

The Institute for Supply Management (ISM) manufacturing purchasing managers' index (PMI) came in at 48.2 in November, indicating contraction in U.S. manufacturing for a ninth straight month.

Sunrun’s big rebound is gaining traction—but does Canyon’s move suggest the recovery is still fragile?

TORONTO — No competing bids for Hudson’s Bay’s royal charter have emerged, paving the way for the Thomson and Weston families to purchase the artifact for $18 million, a source says. The Canadian Press is not naming the source familiar with the auction process because they were not authorized to speak publicly. The charter signed [...]

TORONTO - No competing bids for Hudson's Bay's royal charter have emerged, paving the way for the Thomson and Weston families to purchase the artifact for $18 million, a source says.

TORONTO — No competing bids for Hudson's Bay's royal charter have emerged, paving the way for the Thomson and Weston families to purchase the artifact, a source says.

TORONTO — No competing bids for Hudson’s Bay’s royal charter have emerged, paving the way for the Thomson and Weston families to purchase the artifact, a source says. The Canadian Press is not naming the source familiar with the auction process because they were not authorized to speak publicly. Holding companies belonging to the two [...]

Q. Will the Filer post office still be open during renovations?

U.S. markets slipped on Monday, with the Dow Jones falling 0.9% to 47,289.33, the S&P 500 easing 0.5% to 6,812.63, and the Nasdaq edging down nearly 0.4% to 23,275.92.These are the top stocks that gained the attention of retail traders and investors through the day:read more

SHAMOKIN DAM — A $1.15 million budget for 2026 was approved by Shamokin Dam Council Monday.